As one of SAP's longest serving partners, Bramasol has seen and participated in many major changes during our 25 years of working in the SAP ecosystem. When we express how excited we are with the new RISE with SAP initiative that was launched in Q1 2021, it comes with that deep history and perspective in mind.

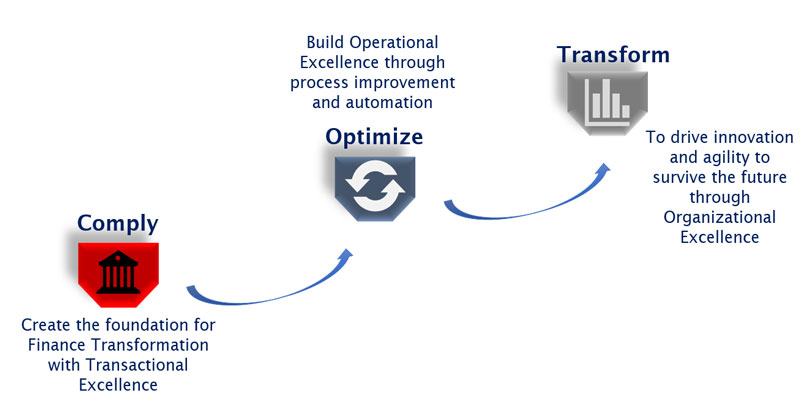

RISE with SAP is the Perfect Complement for Comply, Optimize, Transform