The global economy is undergoing a profound transformation. Products are turning into platforms, services are being bundled with data and experiences, and value is shifting from one-time transactions to continuous relationships. This new paradigm, known as the Digital Solutions Economy (DSE), is redefining how companies create, deliver, and monetize value. It’s an economy built on subscriptions, usage-based billing, outcome-driven engagements, and dynamic bundling of products and services.

In parallel, the shift to Cloud ERP is turning core processes into configurable, continuously updated services, with enterprise AI (such as gen-AI, predictive, & agentic) across finance, supply chain, commercial, and service layers, feeding decisions with real-time telemetry and AI analytics. Meanwhile, DSE models (subscriptions, pay-as-you-go, outcome SLAs, bundling of products + services + data) are shifting revenue profiles, cash flow timing, and customer success motions.

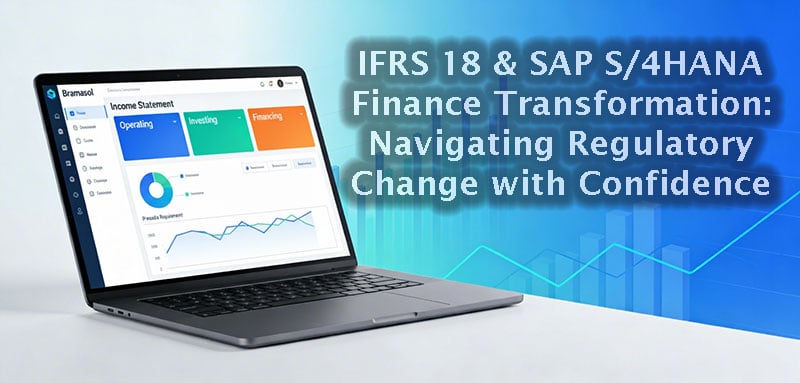

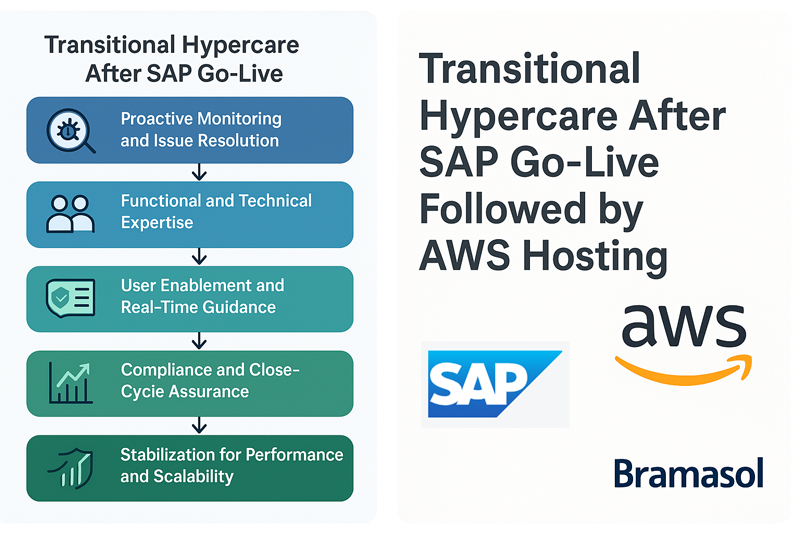

At the center of these transformational changes, SAP provides a comprehensive technology platform, based around an end-to-end, cloud-based, intelligent digital core that connects and unifies processes across finance, sales, service, and supply chain. Partnering alongside SAP is Bramasol, a long-time innovation leader helping enterprises turn these technologies into real-world growth, compliance, and performance.

How C-Suite Roles are Changing

CEO: From strategy and oversight to orchestration of an AI-enabled business

The CEO’s role is transforming from managing various operational silos to orchestrating growth across the enterprise and throughout the entire customer lifecycle.

New mandates:

- Business model agility: Rapidly test/launch hybrid offers (hardware + software + services + data) with dynamic bundling and price experimentation; scale what wins.

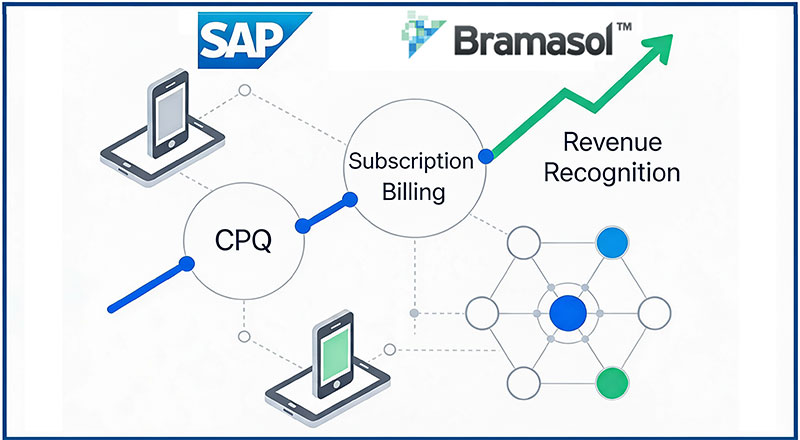

- Operating model convergence: Collapse silos between Sales, Product, Finance, and Service into Revenue Operations (RevOps) and Customer Success spine powered by the ERP + CPQ + billing + RevRec stack.

- AI ambition with guardrails: Set enterprise AI North Star defining where to differentiate vs. standardize, along with clear risk and ethics boundaries.

Key CEO decisions

- Approve a portfolio governance cadence with quarterly lifecycle reviews (create → price → sell → bill → renew → expand → retire).

- Sponsor a connected-data program to unify product, customer, usage, financial and service data as strategic assets (not IT projects).

- Tie leadership incentives to Lifetime Value (LTV) and Customer Acquisition Cost (CAC), focusing on expansion of Annual Recurring Revenue (ARR), Monthly Recurring Revenue (MRR) net revenue retention (NRR), attach/upsell, and time-to-value.

CFO: From historical reporter to subscription economics architect

For DSE and digital transformation, the CFO becomes the economic architect of the business model. Instead of primarily analyzing and reporting on results, finance now shapes monetization strategy and ensures every revenue stream is compliant, auditable, and predictable.

New mandates:

- Revenue architecture: Own the compliance-safe bridge from quote → contract → usage → invoice → revenue recognition (ASC 606/IFRS 15), including Standalone Selling Price (SSP) management for bundles and promotions.

- Predictive finance: Use AI to forecast ARR/MRR, cash collections, churn/expansion, and scenario test pricing/packaging changes before go-live.

- Monetization governance: Chair a Monetization Council (pricing, offers, incentives, discounting thresholds) with real-time guardrails embedded in CPQ and billing.

- Close and compliance automation: Drive continuous close, automated reconciliations, anomaly detection, and policy enforcement.

CFO dashboards/KPIs:

- Topline: ARR/MRR, NRR, Gross Revenue Retention (GRR), bookings mix (new vs. expansion), attach & bundle penetration, usage, bill yield.

- Profitability: Gross margin by offer, cloud COGS, service utilization, promotional leakage.

- Cash: Billings, collections velocity, DSO, renewal cash profile.

- Controls: RevRec exceptions, SSP variance, quote/contract policy breaches, audit-ready traceability.

CIO: From systems owner to platform and data product GM

For CIOs, the DSE era requires a clean-core ERP that can adapt quickly to new offers and partnerships. CIOs design and implement composable architectures using SAP S/4HANA Cloud and the SAP Business Technology Platform (BTP)—keeping the ERP core stable while enabling agility at the edges.

New mandates:

- Composability & integration: Operate the ERP as the stable core with API-first edges (CPQ, BRIM/billing, commerce, CX, service). Deliver a clean core with extensibility via side-by-side services.

- Data & AI platformization: Productizing data across multiple views (customer 360, product 360, usage 360, financial 360). Governing features and secure access patterns for AI agents.

- AI in production: Stand up AI Ops and ML Ops pipelines, prompt/feature stores, evaluation harnesses, and drift monitoring. Make “human-in-the-loop” and policy-as-code enforceable.

- Cyber & trust: Secure PII/usage/financial data; implement privacy-preserving analytics and vendor risk management for AI models.

CIO success metrics

- Time-to-launch for new offers, percent of processes automated, API reuse capabilities,

- Cost-to-serve per transaction, model performance/SLA, and security posture (mean time to detect/respond).

How the Digital Solutions Economy (DSE) is Altering the Landscape

DSE is more than a new billing model—it’s a business transformation. Companies in every industry are moving toward models where customers pay for what they use, what they achieve, or the outcomes they experience, rather than simply owning a product.

Key DSE characteristics include:

1) Subscription & usage-based monetization

- Design: Flexible rate plans (tiered, volume, commit + overage), trials, promotions; usage instrumentation from devices/apps.

- Finance impact: Deferred revenue, variable consideration, SSP across bundles; need for auditable, automated RevRec.

- Data loop: Telemetry → entitlement → billing → revenue → product roadmap.

2) Dynamic bundling & lifecycle offers

- Real-time Configure, Price, Quote (CPQ) guardrails for compatibility, regulatory rules, and margin floors.

- CFO sets pricing corridors and AI proposes cross-sell/upsell bundles based on persona, segment, and observed usage.

- Post-sale customer success motions (adoption playbooks) influence expansion of ARR and churn prevention.

3) Service-led growth

- Outcome SLAs, predictive maintenance, and AI support copilots reduce downtime and create expansion paths.

- Unified cost-to-serve and margin visibility at the offer + account level enables surgical pricing changes.

Summary

In the Digital Solutions Economy, success isn’t about selling more things—it’s about building enduring value. With SAP as the end-to-end intelligent core and Bramasol as your guide, that future is already within reach. With Bramasol and SAP, companies are able to enable new DSE models and transform enterprise-wide processes to achieve overarching benefits, including:

- Time-to-Market Agility: Launch new subscription and usage-based offerings in weeks, not months.

- Lifecycle Revenue Intelligence: Real-time visibility into ARR, NRR, margin by offer, and renewal health.

- Sustainability Integration: Embedding ESG and “triple bottom line” reporting into the business model.

- Cross-Functional Alignment: A unified KPI framework linking strategy, finance, and operations around customer lifetime value.

This is the new enterprise model: agile, intelligent, and financially transparent.