In today’s rapidly evolving Digital Solutions Economy, the lines between products and services are blurring. Companies across many industries, from high-tech manufacturers to software providers, telecoms, and professional services firms, are embracing subscription-based and bundled business models. These models promise stronger customer relationships and more predictable revenue streams, but they also introduce new levels of operational and financial complexity. Managing combinations of physical products, digital services, and recurring subscriptions requires precision, flexibility, and real-time coordination across multiple systems.

That’s where Configure, Price, Quote (CPQ) solutions come in. Previously viewed as simply sales support tools, modern platforms such as SAP CPQ have become the strategic foundation for unifying the front-end and back-end of the Quote-to-Cash (QTC) process in a world defined by recurring revenue and hybrid offerings.

The Expanding Role of CPQ in the Digital Solutions Economy

Traditional quoting processes were designed for static, one-time sales. A sales representative could select a few SKUs, apply a discount, and hand off the order for fulfillment. But when a company starts offering subscriptions, consumption-based services, or bundled solutions that combine hardware, software, and support, the picture changes dramatically. Each quote now represents a "living contract" that must evolve over time as customers renew, upgrade, or change their plans. Without an intelligent CPQ system, managing these variations quickly becomes cumbersome and error-prone.

CPQ now needs to solve this complexity by automating configuration and pricing logic, ensuring that every quote is both technically valid and financially accurate. It also should provide guided selling capabilities that help sales teams and partners build optimized offerings aligned with both customer needs and profitability targets.

More importantly, modern CPQ systems can model complex subscription terms, such as recurring billing, tiered pricing, usage-based fees, and mid-term amendments, while maintaining full traceability for revenue recognition and compliance. This level of control is critical for meeting ASC 606 and IFRS 15 requirements and for maintaining clear visibility into recurring revenue streams.

How SAP CPQ Powers Intelligent Selling and Subscription Management

SAP CPQ is designed specifically for today’s connected, subscription-driven business landscape. It goes beyond simple quote generation by enabling organizations to manage the entire configuration-to-contract lifecycle with agility and intelligence. SAP CPQ’s powerful configuration engine supports intricate product and service hierarchies, ensuring that bundles and subscription components always meet predefined compatibility and pricing rules. Its flexible pricing engine accommodates everything from one-time charges to recurring and usage-based models, allowing companies to design offerings that adapt to customer demand and market trends.

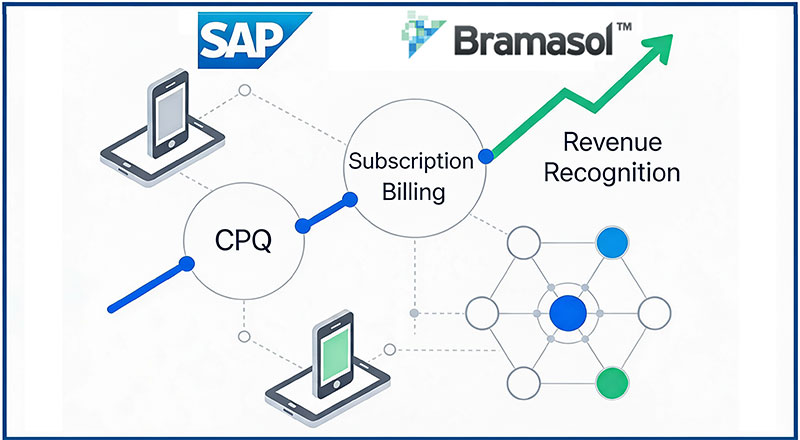

By using guided selling interfaces, SAP CPQ simplifies even the most complex selling motions, empowering sales teams to create tailored quotes quickly and confidently. Integration with SAP Subscription Billing or SAP Billing and Revenue Innovation Management (BRIM) extends this intelligence into downstream billing and revenue recognition, ensuring smooth continuity from quote creation to invoicing and financial reporting.

The Power of Integration with SAP S/4HANA Cloud ERP

The real magic happens when SAP CPQ is seamlessly integrated with SAP S/4HANA Cloud ERP, creating a fully connected Quote-to-Cash ecosystem.

On the front-end, this integration allows sales teams to operate with confidence, knowing that product data, pricing structures, and contract terms are consistent across all systems. Real-time visibility into inventory, service availability, and contract status helps sales reps deliver accurate, customer-centric quotes without waiting for manual checks or back-office confirmation.

On the back-end, once a quote is approved and converted into an order, all relevant details, products, subscriptions, pricing, and billing terms, flow directly into SAP S/4HANA. This eliminates data duplication and ensures that fulfillment, billing, and revenue recognition are aligned. Finance teams gain the ability to track recurring revenue, recognize it properly over time, and forecast future cash flows with precision.

Because the data flows are unified, both sales and finance teams operate from a single source of truth. This integration not only improves operational efficiency but also strengthens compliance, auditability, and customer satisfaction.

Creating End-to-End Business Agility in SAP Cloud

For companies navigating the shift toward recurring revenue models, SAP CPQ integrated with SAP S/4HANA Cloud ERP represents more than a technology deployment—it’s a business transformation enabler. Together, they bridge the traditional gap between sales and finance, unifying customer experience with operational excellence.

With SAP CPQ, organizations can design and sell even the most complex offerings with speed and accuracy. With SAP S/4HANA Cloud ERP, they can deliver, bill, and account for those offerings seamlessly. The result is a connected enterprise capable of supporting the full lifecycle of subscription-based and bundled business models—from configuration and quoting all the way through fulfillment, billing, and revenue recognition.

Bramasol: The Bridge Between Technology and Transformation

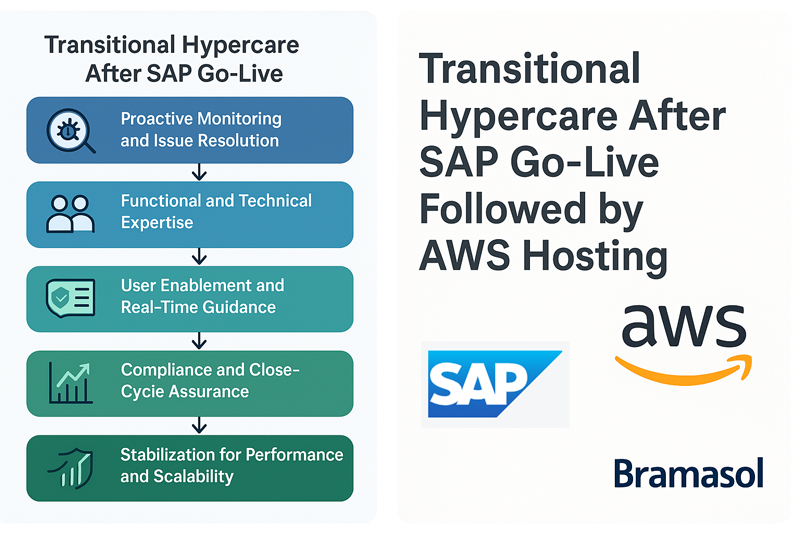

While SAP CPQ and S/4HANA Cloud provide the technology foundation, Bramasol brings the expertise that makes transformation work in the real world. As a long-time SAP Partner and pioneer in the Digital Solutions Economy, Bramasol has helped companies across industries—from high tech and life sciences to manufacturing and professional services—design and implement end-to-end recurring revenue architectures.

Bramasol’s deep experience in Revenue Recognition (RevRec), Subscription Billing, and BRIM (Billing and Revenue Innovation Management) ensures that every CPQ implementation aligns with both front-end sales agility and back-end financial accuracy. The Bramasol team also integrates advanced AI, analytics, and reporting tools that give CFOs and sales leaders real-time visibility into pricing performance, renewals, and revenue forecasts.

In short, Bramasol ensures that SAP CPQ is not just a sales tool—but a strategic enabler of the company’s entire recurring revenue lifecycle.

Optimizing Business Value with Agility, Accuracy, and Alignment

When SAP CPQ is implemented under Bramasol’s guidance and integrated with SAP S/4HANA Cloud ERP, companies gain a unified ecosystem that delivers measurable results:

- Accelerated sales cycles through guided selling and automated quoting.

- Seamless order-to-billing execution with no data duplication or delays.

- Accurate, compliant revenue recognition aligned with ASC 606 / IFRS 15.

- Actionable insights into recurring revenue trends, renewals, and margin performance.

- Future-ready scalability to support new business models as the Digital Solutions Economy continues to evolve.

Bringing It All Together

In the Digital Solutions Economy, success depends on more than just great products; it depends on the ability to sell, renew, and expand relationships intelligently. SAP CPQ, powered by its deep integration with SAP S/4HANA Cloud, gives companies the tools to do exactly that by delivering agility, accuracy, and insight across the entire revenue lifecycle.

SAP CPQ, when integrated with SAP S/4HANA Cloud ERP, provides the technology backbone for managing complex offerings with confidence. But success ultimately depends on expert implementation and strategic alignment. That’s where Bramasol stands out by combining unmatched SAP expertise with decades of experience helping companies transform their Quote-to-Cash processes, optimize revenue recognition, and thrive in the Digital Solutions Economy.

For organizations looking to build a recurring revenue business that’s as financially sound as it is customer-focused, the path forward is clear: SAP CPQ + SAP S/4HANA Cloud, powered by Bramasol’s expertise.

For a deep dive into SAP CPQ, register for this webinar on November 20, 2025