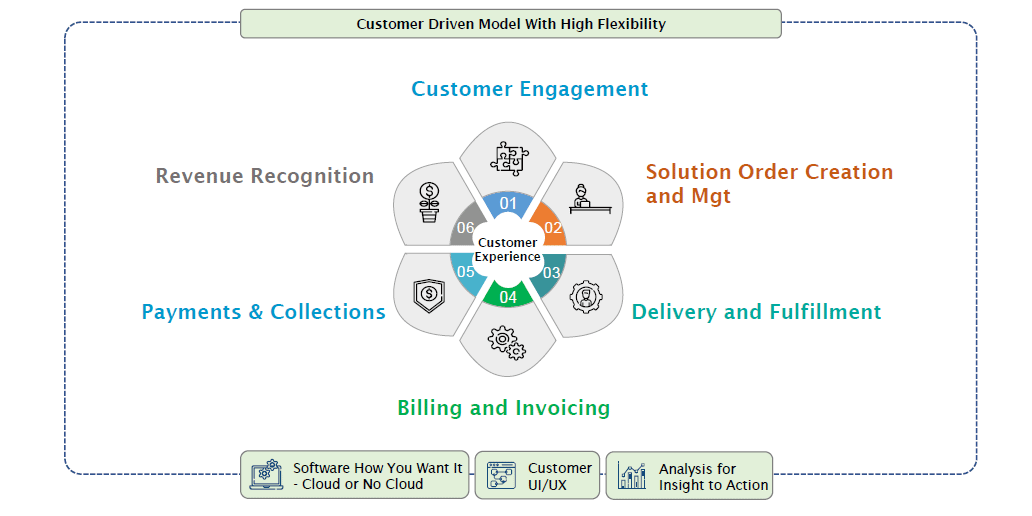

The role of enterprise level CFOs has changed radically over the past decade with both a widening scope of influence and greater responsibilities for helping guide corporate transformation programs and technology choices. Instead of the historic backward-looking role focused primarily on gathering and reporting data, the Office of the CFO is now much more involved in proactively analyzing trends and formulating forward-looking strategies to drive future company results.

Unifying Operational Accounting and Compliance Accounting in the Office of the CFO

.png)