Treasury is one of the most important aspects within the Office of the CFO and is a critical factor for success in every company. However, treasury functions are not always unified and integrated. In too many companies, the evolution of disparate applications for cash, banking, risk management and other key treasury missions has created a patchwork of legacy systems that can stifle productivity and increase risks.

As the move toward digitalization continues to accelerate everywhere, CFOs and their organizations are becoming more empowered to overcome these application silos and enhance true interconnectedness of processes, data, and analytics-driven management.

When we think of “treasury” the obvious issues that always come to mind are cash, risk, and working capital. However, it’s also important to remember that treasury touches virtually everything throughout the enterprise. For example, areas such as HR payroll, supply chain logistics, AR/AP, procure-to-payment, quote-to-cash, taxes, and many others all impact various aspects of treasury management on a daily basis.

To elevate treasury management to the next level and realize true Business Process Intelligence (BPI), CFOs and their staff must achieve a broader and deeper level of end-to-end visibility into all areas that impact the organization’s financial health.

Further exacerbating the challenge is the fact that treasury is not the only area that is undergoing significant changes from digital transformation. Market dynamics and globalization trends are also radically changing go-to-market, sales, and delivery approaches, which creates a moving target for treasury transformation.

The move toward various service-focused offerings such as subscription services, product sales with accompanying memberships, and many other everything-as-a-service (XaaS) offerings mean that treasury needs the agility to track and scale up revenue management and compliance processes for very dynamic, customer-driven transactions. At the same time, globalization is driving a proliferation of banking relationships and regulatory requirements on a country-by-country and regional basis that adds another layer of complexity to enterprise-wide treasury management.

So, how can CFOs, treasurers and their staff cope with these sweeping challenges?

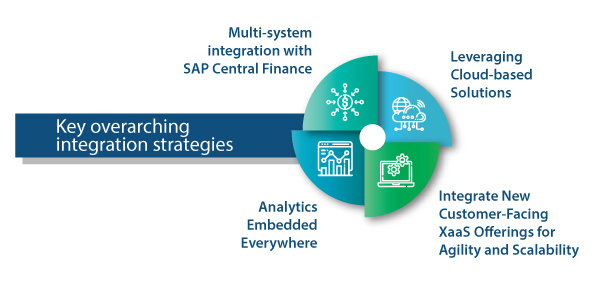

Some of the key overarching integration strategies are outlined below:

Multi-system integration with SAP Central Finance:

By leveraging flexible and agnostic solutions, such as SAP Central Finance, companies can rapidly interconnect legacy systems seamlessly to immediately improve overall treasury integration while at the same time laying the foundation for a phased transition to full S/4HANA system functionality. As a native S/4HANA application, Central Finance ignites all the power of S/4HANA, such as unified analytics, predictive modeling, simulation, accounting, treasury, and compliance tools, along with the ability to roll-up and process huge amounts of data with a high degree of dimensionality and transparency – all while maintaining live connectivity with legacy environments.

Analytics Embedded Everywhere:

It is also important to shift our thinking about analytics from viewing it as an add-on or standalone function to considering it a vital part of everything that is embedded within virtually all systems and processes. For example, at Bramasol, we incorporate advanced analytics-driven dashboards into all our implementations, IP-based solutions, disclosure reporting modules and other offerings. We have standardized on core enabling SAP solutions, such as SAP Cloud Analytics and SAP Fiori, along with agnostic connector solutions such as SAP Central Finance, Revenue Accounting and Reporting (RAR), and Contract and Lease Management (CLM). (See this previous blog for more on analytics.)

Leveraging Cloud-based Solutions:

As we all know, cloud-based solutions have become ubiquitous. While many enterprises are not yet ready to move their entire finance, ERP and business systems to the cloud, the reality is that a growing number of their operational and finance applications are already cloud-based, which offers ready-made opportunities for integration. Here again, the use of agnostic, cloud-enabled integration tools such as SAP Central Finance, SAP Cloud Platform and SAP Analytics Cloud (SAC) can be key to unifying existing cloud apps into a seamless, meaningful, and manageable environment, while also enabling advanced reporting capabilities.

Integrate New Customer-Facing XaaS Offerings for Agility and Scalability:

If you are going to play in the new everything-as-a-service and customer-experience based markets, your old finance and management tools are destined to come up short. Dynamic flexibility is critical for managing and accounting for these new revenue streams but be careful not to sacrifice integration by implementing narrow standalone software approaches. That is why at Bramasol we have standardized on SAP Billing and Revenue Integration Management (BRIM) as the go-to solution for helping clients deploy next-gen XaaS offerings. BRIM is designed from the ground up to support dynamic customer-facing systems while incorporating the integration, agility, and scalability to assure success and compliance over the long-run.

In summary, the bottom line is that CFOs and their staff need to always think “integration” whenever they think about any aspect of treasury management. Treasury is embedded in the DNA of your company and therefore is a fundamental part of virtually everything – at the cellular level.

In the recent announcement of RISE with SAP, another giant step forward in Business Process Intelligence, SAP CEO Christian Klein underscored the importance of deploying an integrated pathway forward that brings together all aspects of the Intelligent Enterprise within a unified, scalable, and inherently adaptable holistic environment.

Given these overarching trends toward digital transformation, it is imperative that CFOs take on the important proactive leadership role of integrating all finance functions across the new environment, starting with treasury.