Over recent years, companies have focused significant time and effort to comply with revenue recognition standards ASC 606 and IFRS 15. In previous blog posts, we’ve drilled down and looked at various aspects of RevRec compliance including the importance of Optimization and Integration, options for deploying SAP RAR in the Cloud, and leveraging Analytics for Disclosure Reporting.

As we start the new year, in this blog post I am shifting the focus to look at some of the next-generation and emerging revenue scenarios that need to be integrated within overall revenue accounting systems.

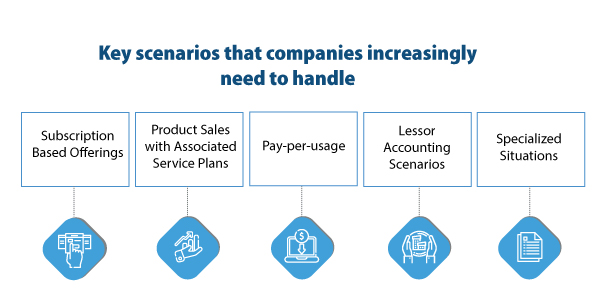

The following are some of the key scenarios that companies increasingly need to handle.

-1.jpg?width=95&name=1%20(1)-1.jpg) Subscription Based Offerings

Subscription Based Offerings

Many new companies as well as an increasing number of existing enterprises are offering subscription-based or pay as you go business models. To create robust offerings for their customers while also effectively managing revenues, they need flexible revenue accounting solutions to deal with billing, invoicing, pricing and complex A/R and A/P processes. When offering a variety of dynamic service offerings, such as multiple tiers and/or the ability for users to switch plans on demand, the backend revenue accounting challenges become even more complicated.

.jpg?width=95&name=2%20(1).jpg) Product Sales with Associated Service Plans:

Product Sales with Associated Service Plans:

In a similar scenario, an increasing number of product companies are offering related service plans, either bundled or as options during the product purchase. These situations require revenue accounting solutions that track with both traditional product sales and ongoing service revenues. Also, some variations on this model need to account for discounts on product sales based on service plan purchases or free initial service periods based on product purchase levels or terms.

.jpg?width=95&name=3%20(1).jpg) Pay-per-usage

Pay-per-usage

Some membership plans are designed around a pay-per-usage model that gives customers dynamic pricing flexibility, such as a web services plan with metered pricing based on volume of data or CPU cycles used per month. However, providing such dynamically tailored consumption-based services to customers requires highly agile backend software systems for revenue recognition and accounting.

.jpg?width=95&name=4%20(1).jpg) Lessor Accounting Scenarios

Lessor Accounting Scenarios

Another scenario applicable to some companies is accounting for revenues based on providing lessor arrangements. Depending on the lease categories they offer, such as operating-type-leases (OTLs) or service-type-leases (STLs), lessor companies may need to account for a variety of factors such as depreciation and residual value along with expenses related to generating the lease revenue streams.

Specialized Situations

Specialized Situations

Other variations in revenue accounting that may occur in relation to the above scenarios are situations such as early termination fees, rebates, free trials, usage of consumables, and additional creative provisions. If any of these scenarios apply, companies need to build in processes for seamlessly accommodating the customers’ desires while assuring backend flexibility for revenue accounting.

Leveraging revenue accounting solutions throughout the SAP ecosystem

When looking at any of the above scenarios, it quickly becomes clear that multi-faceted, cross-functional solutions are required. Companies that initially chose to comply with ASC 606 / IFRS 15 using limited standalone software or offline spreadsheets quickly will hit the wall if they try to use those approaches for handling these advanced revenue models.

As leaders in RevRec compliance solutions and a co-innovator with SAP, Bramasol has been a prime mover in the development, deployment and integration of SAP Revenue Accounting and Reporting (RAR). While RAR provides a robust, flexible, and scalable foundation for revenue management, it still needs to be integrated with related applications to accommodate all the nuances of next-gen revenue generation models.

One of the key complementary applications that we have successfully integrated for customers is SAP Billing Revenue Innovation Management (BRIM). BRIM was specifically designed to help companies monetize digital transformation to new revenue models by providing flexibility, transparency, and scalability for automated billing, invoicing, and revenue management. Available as modular solutions or as a package, we help enable our customers to rapidly build and monetize business models. We enable their business users to simply design pricing models through configuration instead of coding.

BRIM enables companies to quickly design and launch new subscription-based offerings, service plans, pay-per-usage or other new innovative revenue offerings that are tailored to meet dynamically changing customer needs while integrating seamlessly with backend financial processes.

It also helps maximize next-gen revenue streams by recognizing customer behavior and identifying upsell opportunities. For example, by tracking customers’ usage data, BRIM can automatically trigger offers for different tier packages, payment plans or additional services. Enhancing the degree of personalization for customers helps strengthen ties and drive higher loyalty for existing clients while also attracting new users by providing convenience, transparency, and ease of use.

Available as targeted modular solutions or as a full suite with options for cloud-deployment, BRIM gives companies a powerful companion application to SAP RAR. When paired with Bramasol’s RAR Cloud-based offering, this gives client companies a variety of deployment choices that make it easier to experiment with adding on next-generation revenue models within existing business activity or to quickly create and scale entirely new offerings.

In addition, because both SAP RAR and BRIM are designed as native S/4HANA applications, companies can build next generation revenue offerings with confidence that their technology choices will map seamlessly into other digital transformation initiatives going forward.

Learn more about how RAR and BRIM lay out a robust foundation for integrating and optimizing revenue management processes for the solutions economy:

- Webinar video: Subscription Economy Revisited, Customer Use Cases with SAP RAR and BRIM

- Webinar video: SAP RAR latest Release in S/4HANA

- Webinar video: Lessor Accounting, The Convergence of RevRec and Lease Accounting