Automakers are turning cars into connected, software‑defined platforms, using subscriptions and recurring services that help extend revenue opportunities far beyond the initial sale, while riding broader shifts toward electrification, autonomy, and mobility‑as‑a‑service. This creates huge upside but also exposes OEMs and fleet managers to new risks in pricing, customer trust, data, and finance operations that have to be managed as carefully as any powertrain or safety system.

Going from one‑time sales to Software‑defined Vehicles

The rise of software‑defined vehicles (SDVs) means a growing share of value is delivered as code that can be updated and monetized over the vehicle’s life, not just at the dealership. OEMs are building software operations that support over‑the‑air (OTA) updates, remote diagnostics, and continuous feature releases, which become the foundation for new recurring revenue streams.

Recurring revenue in automotive is emerging at several layers of the value stack.

- In‑vehicle feature subscriptions: OEMs now charge recurring fees for advanced driver‑assist, premium infotainment, connectivity, performance modes, and other “features‑as‑a‑service,” with Tesla’s shift of Full Self‑Driving to subscription‑only a prominent example.

- Connected services and data: Remote vehicle monitoring, predictive maintenance, navigation, and telematics are sold as ongoing services, with connected offerings becoming an increasingly important slice of automaker revenue.

- Vehicle and mobility subscriptions: Car subscription programs bundle access to vehicles, maintenance, insurance, and sometimes EV charging into monthly packages, positioned between leasing and on‑demand mobility.

These models align with broader consumer trends toward flexibility and “access over ownership,” especially among younger drivers who prefer configurable, on‑demand mobility and always‑up‑to‑date digital experiences.

Strategic challenges behind the subscriptions

The commercial story is compelling, but the execution is non‑trivial.

- Customer trust and value perception: Drivers can resent paying monthly for features they feel were already “in the car,” so OEMs must make the value of ongoing services (safety, convenience, performance, updates) obvious and transparent.

- Pricing and packaging complexity: Hybrid models that mix base subscriptions with usage‑based or time‑limited upgrades require sophisticated catalog, discount, and lifecycle logic, far beyond traditional trim‑level pricing.

- Regulatory, safety, and cybersecurity: Safety‑relevant features and OTA updates must meet regulatory expectations and robust security standards while also supporting granular entitlements and billing.

- Financial and operational rigor: Finance teams must separate billed cash from recognized revenue under standards like ASC 606, to track performance obligations over time, and contract history when customers change plans mid‑term.

How recurring revenue fits broader auto trends

Recurring revenue models sit at the intersection of several long‑run automotive shifts.

- Electrification: EVs reduce mechanical service revenue, so OEMs look to software, energy services, and connected offerings to maintain lifetime value.

- Autonomy and ADAS: Advanced driver‑assist systems and autonomous features need constant software refinement; subscriptions give OEMs a way to fund ongoing development while delivering updates via OTA.

- Mobility ecosystems: Vehicle and fleet subscriptions integrate with ride‑hailing, car‑sharing, and corporate mobility programs, turning OEMs into service providers rather than pure manufacturers.

- Data monetization: Connected vehicles generate rich data that can support insurance, fleet optimization, mapping, and personalized offers, often bundled with or enabled by subscription services.

In this context, recurring revenue is not an isolated tactic; it is how OEMs monetize the software and connectivity required for EVs, ADAS, and integrated mobility strategies.

What automakers need under the hood

To make these models sustainable, automakers need a robust digital and financial backbone.

- Entitlement and feature management to govern which drivers and vehicles can access which software capabilities, aligned with subscriptions, trials, and promotions.

- Usage and event metering to count miles, days, activations, or data consumption for hybrid pricing and to detect anomalies or abuse.

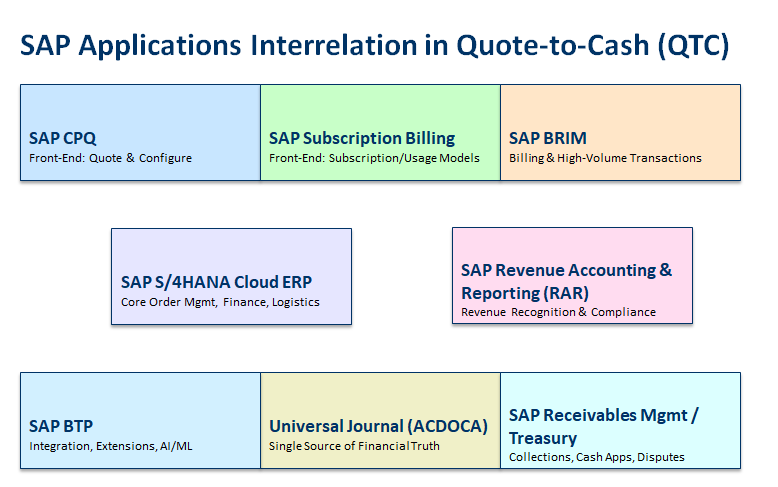

- Integrated quote‑to‑cash and subscription billing so dealers, digital channels, and in‑car purchases all flow into one consistent contract and billing record.

- Automated revenue recognition capable of handling evolving performance obligations across multi‑year vehicle lifecycles, contract modifications, and bundles that mix hardware, software, and services.

When these elements are in place, recurring revenue becomes more than an experimental upcharge; it turns into a disciplined, scalable business model that complements the sector’s broader transformation toward software‑defined, connected, and service‑centric mobility.