In past blog posts, we have explored how Treasury Integration is Key to Optimizing Digital Transformation and have covered the Digital Solutions Economy (DSE) from several different perspectives. In this post we'll take a look at how DSE is impacting various aspects of Treasury Management and explore the implications from a treasury perspective.

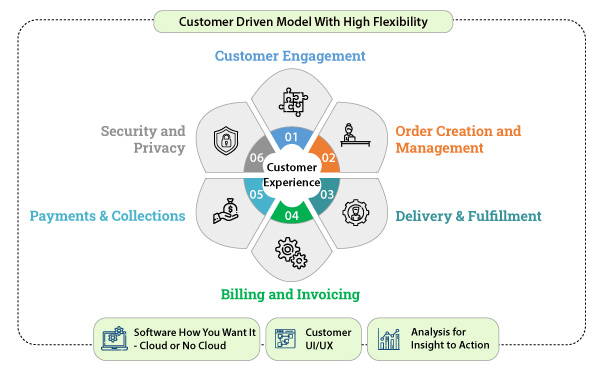

First, here's a quick recap on the six key elements of the Digital Solutions Economy. As shown below, everything in DSE revolves around the customer experience. Customers want to engage with your business on their own terms, which means at their convenience, according to their time schedule, and with full control over how they configure and personalize their purchases.

This plays out in how customers are first engaged through your ecommerce presence, followed by how customer choices impact order creation, delivery & fulfillment, billing and invoicing, payments, and your revenue management processes. DSE is inherently broad in its impact and is driving disruptive changes in all these areas.

On the other side of the coin, treasury processes and management requirements are also inherently wide-ranging, touching virtually everything in the enterprise. So it's natural to expect that the changes driven by DSE are intersecting with Treasury Management in a variety of ways.

Let's look a few examples:

Cash flow - DSE significantly impacts cash flow in both positive and negative ways. The dynamic nature of DSE's "customer-in-charge" approach means there is a proliferation of ordering and payment options, which in turn requires cash management processes to be more agile and flexible. On the plus side, the subscription-based aspects of DSE offer opportunities in many cases to create more predictable recurring revenue streams, which can help greatly with revenue and cash forecasting. The use of end-to-end, embedded analytics will play a key role here, as well as in other treasury management functions.

Cash flow - DSE significantly impacts cash flow in both positive and negative ways. The dynamic nature of DSE's "customer-in-charge" approach means there is a proliferation of ordering and payment options, which in turn requires cash management processes to be more agile and flexible. On the plus side, the subscription-based aspects of DSE offer opportunities in many cases to create more predictable recurring revenue streams, which can help greatly with revenue and cash forecasting. The use of end-to-end, embedded analytics will play a key role here, as well as in other treasury management functions. Working Capital - Because delivery and fulfillment processes in DSE business models are becoming more diverse, including the use of third-party fulfillment and logistics services, there are more moving parts to keep track of in the working capital arena. Therefore, treasury professionals need real-time access to dynamically changing data across a wider scope of inventory repositories, in-process fulfillment centers, shipping methods, etc. One key effect of the DSE is a reduction in the Days Sales outstanding. In the automated “subscription” model the payment is automatic, as well, and reduces outstanding A/R.

Working Capital - Because delivery and fulfillment processes in DSE business models are becoming more diverse, including the use of third-party fulfillment and logistics services, there are more moving parts to keep track of in the working capital arena. Therefore, treasury professionals need real-time access to dynamically changing data across a wider scope of inventory repositories, in-process fulfillment centers, shipping methods, etc. One key effect of the DSE is a reduction in the Days Sales outstanding. In the automated “subscription” model the payment is automatic, as well, and reduces outstanding A/R.  Taxes - Government entities and taxing jurisdictions around the world are closely watching the rise of the Digital Solutions Economy and in many cases are feeling the pinch as they lose revenue from the disruption of conventional brick-and-mortar retail stores. As these taxing authorities make adjustments to get their "slice of the pie" from new DSE models, corporate treasury staff will need better and more agile tools for understanding the changing tax obligations and meeting new requirements while optimizing profitability.

Taxes - Government entities and taxing jurisdictions around the world are closely watching the rise of the Digital Solutions Economy and in many cases are feeling the pinch as they lose revenue from the disruption of conventional brick-and-mortar retail stores. As these taxing authorities make adjustments to get their "slice of the pie" from new DSE models, corporate treasury staff will need better and more agile tools for understanding the changing tax obligations and meeting new requirements while optimizing profitability. Foreign Exchange (FX) - With most DSE business models being implemented globally across many countries and regions, the issues around managing FX are becoming more complex and important to bottom line optimization. Many companies are taking a deeper look at tools such as in-house cash, payment factories, hedging and FX risk management.

Foreign Exchange (FX) - With most DSE business models being implemented globally across many countries and regions, the issues around managing FX are becoming more complex and important to bottom line optimization. Many companies are taking a deeper look at tools such as in-house cash, payment factories, hedging and FX risk management. Compliance - Even as DSE radically changes business models and operational processes, the requirements to comply with various accounting and reporting mandates still apply. In addition to DSE's impacts on revenue recognition and reporting (ASC 606 and IFRS 15), companies also need to incorporate DSE changes into broader financial reporting requirements, such as SOX, ICFR, and others. Here again, tight integration of compliance applications and end-to-end, embedded analytics capabilities will be critical for success.

Compliance - Even as DSE radically changes business models and operational processes, the requirements to comply with various accounting and reporting mandates still apply. In addition to DSE's impacts on revenue recognition and reporting (ASC 606 and IFRS 15), companies also need to incorporate DSE changes into broader financial reporting requirements, such as SOX, ICFR, and others. Here again, tight integration of compliance applications and end-to-end, embedded analytics capabilities will be critical for success.

So, what should you be doing now? If your company is moving toward or already started an implementation of Digital Solutions Economy business model, it is critical to include early involvement of treasury management staff and others within the Office of the CFO.

If possible, even the earliest conceptualization, design thinking and decision-making processes for DSE should seek inputs from treasury professionals regarding the topics detailed above and how existing treasury processes will need to change to provide optimal support for DSE implementation.

At Bramasol, as we work with companies on DSE planning and implementation, we always recommend creating a broad-based project team that includes stakeholders from all key impacted areas - treasury management is invariably high on the list of participants.

Check out these resources to learn more about Treasury, DSE and how they are intertwined.