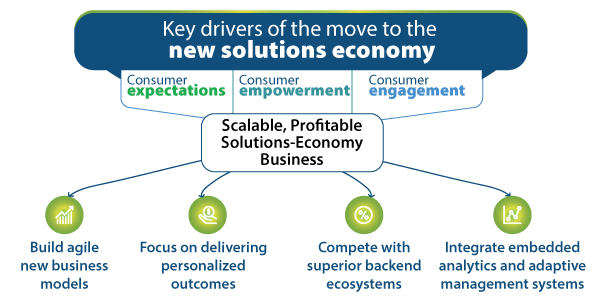

This blog is part of an ongoing series on the Digital Solutions Economy™ (DSE). For additional context on DSE, please see my blogs on “The Digital Solutions Economy is More Than Just Subscriptions” and “Disruption is Happening in Consumer Products Companies. How Should You Deal with It?”

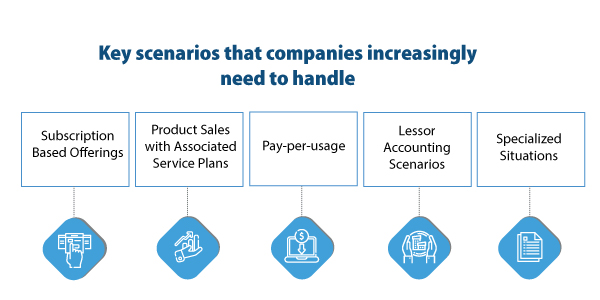

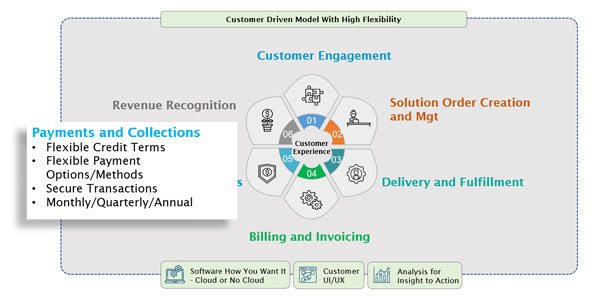

Managing Payments and Collections in the Digital Solutions Economy™