This blog is part of an ongoing series on the Digital Solutions Economy™ (DSE). For additional context on DSE, please see my blogs on “The Digital Solutions Economy is More Than Just Subscriptions” and “Disruption is Happening in Consumer Products Companies. How Should You Deal with It?”

In this blog, we take a deeper look at the issues surrounding payment and collections with a focus on how to make sure these vital processes provide the range of choice demanded by customers while also enabling all the backend mechanisms and controls needed for scalability, compliance, and profitability.

In the Digital Solutions Economy, customers want to engage with your business on their own terms, which means at their convenience, according to their time schedule, and with full control over how they configure and personalize their purchases. This demand for flexibility also applies to how they want to pay for it.

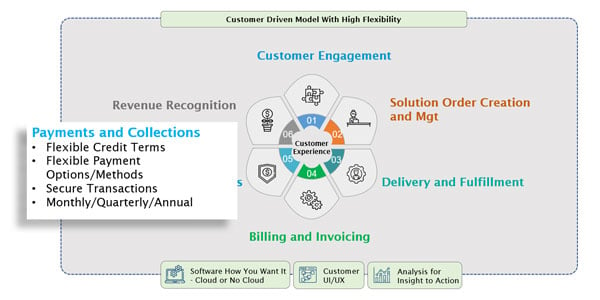

As shown below, these customer expectations encompass:

- Flexible Credit Terms

- Flexible Payment Options & Methods

- Secure Transactions

- Monthly, Quarterly, or Annual Payment Options

The payments and collection process builds on the billing and invoicing section, where you must be able to provide customers with easy-to-understand consolidated invoices that show all the relevant charges – and are both itemized for the customer and aligned with how you need it structured to drive your payments and collections processes.

When it comes to the actual payment options, the dynamics of today’s global markets and currency alternatives have created a complex multi-faceted picture that gives buyers lots of options your company will need to at least consider supporting.

For example, while most customers will continue to use conventional credit cards, many will prefer options such as checks, wire transfers, money market transfers, or new methods such as Venmo, Amazon pay, Apple pay or eBay’s new payment option or even cryptocurrencies (Bitcoin, Dogecoin, Ethereum, etc.) Also, some customers may want to pay over an extended period of time with installments.

In addition, as the Digital Solutions Economy evolves to encompass more B2B scenarios, beyond the current explosion of B2C offerings, there will be an increasing need to accommodate purchase orders, payment terms, and foreign currency (FX) processing.

This universe of preferred customer payment options is likely to keep expanding, so you need to design your Digital Solutions Economy implementation for agile adaptability to incorporate new alternatives while also scaling up your DSE processes.

When considering implementation of a Digital Solutions Economy business model, it is always important to take a comprehensive approach from the outset that integrates all the six key aspects as shown in the graphic above. Payments and collections are only a part of the holistic picture.

Your implementation needs to foster a seamless flow from the initial customer engagement all the way through order processing, delivery and fulfillment, billing & invoicing, payment & collection and finally revenue management for proper compliance.

Starting with a piecemeal approach is a sure way to find yourself either spending much more down the line to integrate disparate pieces of the puzzle and/or losing customers because your system cannot provide the seamless simplicity that they have come to expect.

Watch for future blog updates as we drilldown on each of these six key elements in the Digital Solutions Economy implementation picture.

For more information you can also:

Download and watch this webcast: Overview of the Digital Solutions Economy