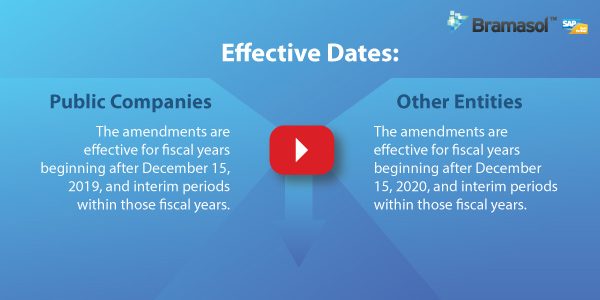

Over recent years, several changes in the compliance landscape, such as ASC 606 / IFRS 15 on Revenue Recognition and ASC 842 / IFRS 16 on Lease Accounting, have radically altered the requirements for what data must be disclosed and how disclosure reporting is handled.

At the same time, major shifts in business models, such as the rise of the subscription economy and the move from product-focused sales to experience-focused solutions are fundamentally changing the ways that revenue is generated.

In addition, most companies are looking for ways to speed up their closing cycles in order to provide investors and other stakeholders with accurate and timely information in a shorter period of time.