This continuing blog series on the Digital Solutions Economy™ (DSE) previously has explored:

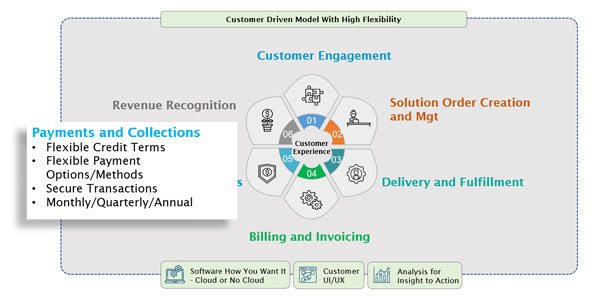

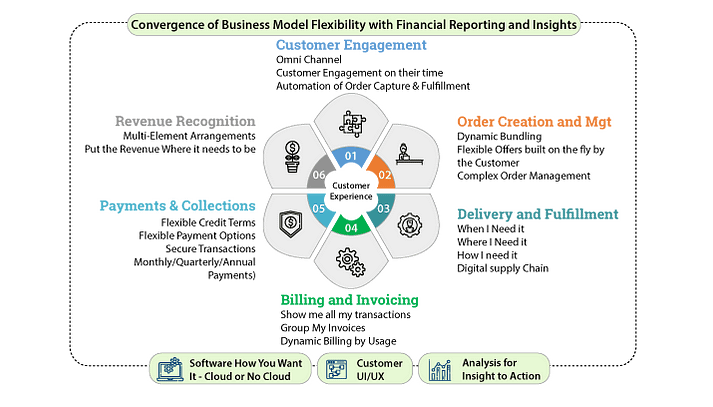

- The Digital Solutions Economy is More Than Subscriptions. Will You Be Ready?

- Managing Payments and Collections in the Digital Solutions Economy

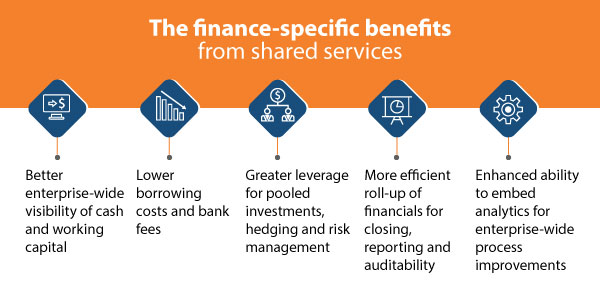

- Finance, Treasury and Working Capital Considerations for the Digital Solutions Economy

- Disruption is Happening for Consumer Products Companies. How Should You Deal with It?

In this new post, we will look deeper at the challenges and key factors for success with regard to management of supply chain and logistics processes as part of a holistic approach to DSE.