Treasury executives are facing an unprecedented confluence of challenges today, with no reasonable prospect that the massive waves of change will be easing up any time soon. In addition to the black swan event of a global pandemic that has literally shutdown economic activity in much of the world, companies are also dealing with other high volatility forces, such as the Russia vs Middle East oil production standoff and global currency fluctuations.

These and other related forces are combining to create significant new challenges for Treasury, which in turn is accelerating the already existing trend toward greater integration and interoperability of various treasury-related software applications. For example, management of cash positions, working capital and hedges against external risk factors are prime focus areas that can benefit from enterprise-wide visibility along with flexible analytics tools and agile response mechanisms.

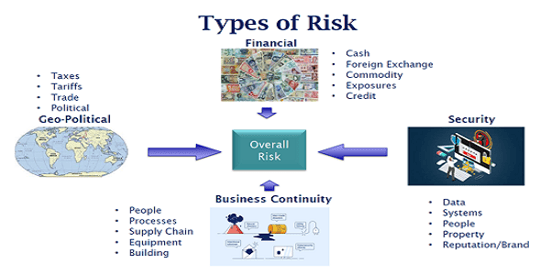

Overall risk management entails these four key areas:

- Financial: Cash, Foreign Exchange, Commodities, Exposures, Credit

- Geo-political: Taxes, Tariffs, Trade, Political

- Business Continuity: People, Processes, Supply Chain, Equipment, Real Estate

- Security: Data, Systems, People, Property, Brand/Reputation

Security issues span all aspects of a business. For more info, watch the video of this webinar on Risk and Exposure. In this post, we are focused on three areas, Financial, Geo-political, and Business Continuity, all of which have significant relevance to enterprise-wide treasury integration.

While every company’s situation is unique, there are several facets of treasury integration that virtually all companies should be addressing. These include:

- Establishing a straight-through processing concept between treasury, Accounts Payable and Accounts Receivable to optimize cash management.

- Expanding usage of electronic bank statement integration and multi-bank connectivity across all regions and business units.

- Leveraging risk mitigation and hedging tools to understand and manage credit, investment, FX and commodity risk areas.

- Integration of advanced supply chain management tools into the overall working capital process to gain insight into payment demands

- Use of agnostic finance integration tools, such as SAP Central Finance, to unify multi-ERP data into an enterprise-wide solution for visibility, management, and reporting requirements.

Creating a straight-through processing flow is an important foundational initiative that opens the way for many other improvements. This entails integrating AP, AR and bank account cash positions in a manner where all of the steps essentially occur in a single flow as opposed to independent steps or, worse yet, separate systems. A straight-through flow not only streamlines processing and boosts productivity; it also increases control and visibility.

Virtually all companies have already become familiar with electronic bank statements but not everyone is yet taking advantage of added benefits from integrating multiple accounts and unifying visibility across the whole enterprise. Seamless enterprise-wide integration using an application such as SAP Banking Connectivity enables treasury executives to improve security, completeness and accuracy of cash management along with key benefits including:

- Insights into where cash is and with whom

- Visibility into real-time cash positions

- Integration with AR and AP to optimize cash posting and return on cash flows

- Meshing cash with workflows to integrate compliance (SOX, ICFR, etc.)

- Reduce the costs of banking fees, compensating balances, etc.

- Enable in-house cash methodologies to defray borrowing needs and optimize cash availability

- Improve overall security, controls, and auditability

In addition, companies are increasingly turning to integrated hedge management applications, such as SAP Hedge and Risk tools that integrate core treasury functions with external resources such as Bloomberg information or the 360T trading platform. This aspect of treasury integration enables finance staff to plan, model and implement hedging strategies while maintaining end-to-end visibility into enterprise-wide cash, commodity, or finance instrument positions along with advanced analytics to monitor and adjust risk mitigation tactics in real time.

On the supply chain front, where many companies invest the bulk of their working capital, applications such as SAP Ariba are enabling treasury executives to integrate overall working capital management with front-line supply chain processes to better optimize both the total amount and turnover cycles for goods in the supply chain pipeline. Enhanced management in this key area can yield dramatic improvements in overall working capital allocation and in turn drive higher bottom-line results.

Finally, enterprise-wide treasury integration can help open the door to overall financial transformation across the enterprise. Ultimately, forward-looking companies are striving to unify all their companywide finance and operational systems but too often are held back by the inertia and “digital debt” associated with maintaining diverse legacy ERPs and other operational systems.

By leveraging flexible and agnostic solutions, such as SAP Central Finance, companies are able to rapidly interconnect legacy systems seamlessly to immediately improve overall treasury integration while at the same time laying the foundation for a phased transition to full S/4HANA system functionality. As a native S/4HANA application, Central Finance ignites all the power of S/4HANA, such as unified analytics, predictive modeling, simulation, accounting, treasury and compliance tools, along with the ability to roll-up and process huge amounts of data with a high degree of dimensionality and transparency – all while maintaining live connectivity with legacy environments.

The bottom line is companies must have an expanded set of tools that can bring all enterprise-wide treasury functions together into a unified and seamless management environment, with the real time visibility, analytics and operational agility needed to navigate today’s tumultuous global environment.

At the same time, companies need to look beyond near-term survival and proactively lay the groundwork for treasury transformation to address future waves of change and to assure financial and operational agility for thriving in whatever the “new normal” may require.