Most of us have encountered situations that call for turning to specialists with deep expertise in a specific area whenever it is critical for our health or safety.

For example, if tests conducted by your primary physician show problems with your heart, you'd expect a referral to a cardiologist rather than having your general practitioner do surgery in their office. Or if the construction of your dream home encounters issues with soil stability in an earthquake prone area, your general contractor can be expected to bring in a trained geological specialist to deal with the situation.

In business, the same concept holds true; especially for situations such as optimizing revenue recognition and reporting compliance for subscription-based product and service offerings, which often include complex entitlements, usage-based scenarios, bundled elements, and/or dynamic, on-the-fly, customer-driven changes within the end-to-end Quote-to-Cash process.

Since our decision a decade ago to focus on becoming the leading partner for delivering SAP revenue recognition solutions, Bramasol has established a reputation as the most trusted RevRec specialist across many industry segments.

Augmented in recent years by our additional specialization in SAP Quote-to-Cash solutions, Bramasol now offers a unique approach for integrating both frontend customer-facing processes and backend compliance processes within a unified approach that can adapt and scale to virtually any requirements.

What Does Co-Specialization in RevRec and QTC Entail?

Bringing an Expanded RevRec "Compliance Mindset" into New Business Models:

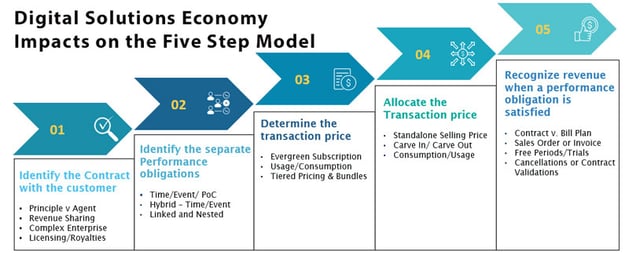

Even though subscription-based, Digital Solutions Economy (DSE) business models are radically changing many industries, RevRec compliance under ASC 606 and IFRS 15 is still required. The Five Step model remains the basic guideline, however the process of performing each step has become more complex. As shown below, factors such as licensing/royalties, time vs. event triggers, usage/consumption, tiered pricing & bundles, and contract modifications all have impacts on determinations of performance obligations (POBs), Standalone Selling Price (SSP) and other aspects in the Five Step Model.

Providing Seamless Integration Between QTC and RecRec Alternatives:

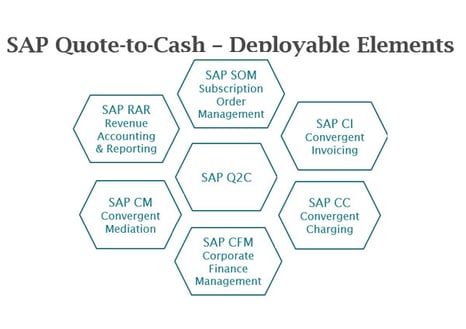

As shown below, the Quote-to-Cash portfolio from SAP (formerly known as BRIM) includes Subscription Order Management (SOM), Convergent Charging (CC), Convergent Mediation (CM), Convergent Invoicing (CI), Corporate Finance Management (CFM) and Revenue Accounting & Reporting (RAR).

However it's important to keep in mind that not all of these elements need to be deployed for every implementation. Depending on each company's specific requirements, legacy systems, and digital transformation roadmap, it can be most efficient and cost effective to selectively implement only those elements that are needed and defer the rest for later or not at all.

Here again, working with experienced QTC and RevRec specialists who understand both the business/accounting issues and the technical capabilities can help companies chart a forward path that delivers in both the near term and over the long run.

Dealing with Changes in Volume, Velocity, Complexity, and Density:

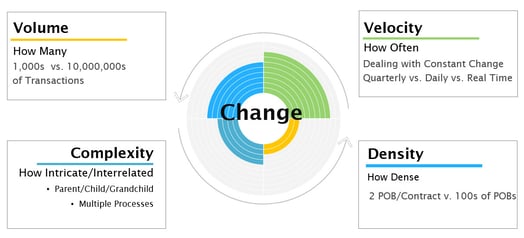

Subscription-based DSE business models inherently generate more data, faster, and with more variations than traditional sales and fulfillment approaches. This offers major benefits in terms of opportunities to deepen customer loyalty and/or upsell with additional related offerings. But if your backend processes can't keep up with the higher data volumes, not only will you lose these Insights to Action benefits; you may very well lose the customers too.

As shown below, these factors can have significant impact on design of the end-to-end processes.

As a specialist in QTC and RevRec solutions, Bramasol works closely with SAP to help customers configure and implement these solutions to meet their unique requirements, while assuring accounting compliance, sustained performance and scalability.

Tailoring QTC and RevRec Solutions for Specific Industry Requirements:

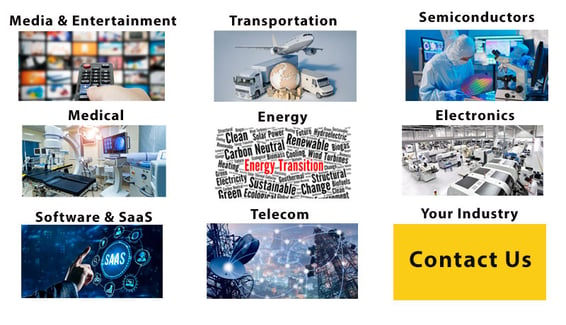

Another very important factor for choosing a QTC and RevRec specialist is the degree to which they understand specific requirements for your industry segment. Ideally, they need to be able to "go broad" in their knowledge of QTC solutions and revenue compliance issues; and they also need to "go deep" with experience implementing new subscription-based DSE models for companies in your industry.

The Bramasol team already has extensive hands-on experience implementing QTC and RevRec solutions across many different industries, including media & entertainment, transportation, semiconductors, medical, energy, electronics manufacturing, software & SaaS, telecom and more. As part of this process, we have also developed a large set of best practices and process templates that can be readily adapted for tailoring to new industry segments.

Summary

Summary

It has long been recognized that in the health care arena, a medical license is a minimum requirement to practice medicine, while obtaining board certification is a rigorous, specialty-specific process that identifies physicians who merit the distinction of being called specialists. Similarly, in the Quote-to-Cash-to-Compliance arena, turning to a specialist can help you navigate the unique challenges associated with complex subscription-based and bundling scenarios.

With over a decade of deep experience, Bramasol is the Revenue Recognition and Accounting leader and a recognized SAP Revenue Recognition services partner for helping companies implement and optimize processes aimed at compliance with the ASC 606 and IFRS 15 standards. Bramasol's SAP-certified experts participated in the majority of early product ramp-ups and have continued to work on more SAP RevRec projects than any other company.

In recent years, we have also been deeply involved in the evolution of SAP BRIM and Quote-to-Cash, with a specialized emphasis on integrating various applications in the BRIM portfolio seamlessly with RevRec accounting and reporting.

Finally, just as turning to a specialist for surgery doesn't mean giving up your primary physician, the Bramasol team is also adept at coordinating with your internal team and any other solutions partners you may already be using. In fact, many of Bramasol's specialized QTC and RevRec projects start with a referral from one of the large accounting firms or SAP itself, as the front-line consultants handling overall programs recognize the need for our deep specialized expertise.

Click Here to Request More Information Regarding Your Unique QTC/RevRec Requirements

For More Information, check out these resources:

- Video: BRIM Overview

- Forecasting and Planning for the Digital Solutions Economy

- DSE and RevRec Compliance,

- DSE Data Volume, Velocity, Density and Complexity

- Embedded Analytics for DSE

- Podcast: SAP's Carla LeJeune on Optimizing Entitlement Management

- Podcast: SAP’s Pete Graham on Anything-as-a-Service and How SAP Enables XaaS

- Webinar video: Managing Entitlements in the Digital Solutions Economy

- Webinar video: Power Transition to DSE with SAP Cash and Treasury Management