This episode in our ongoing series on the Digital Solutions Economy (DSE) provides an overview of how DSE is impacting the Medical Devices Industry. Click here to read episodes on DSE in the Utilities Industry, and DSE in the Oil, Gas and Energy Sector.

Overview

The medical device market has traditionally evolved around a capital equipment acquisition model in which customers, such as hospitals, clinics or other providers, purchase or lease the equipment and separately purchase consumables and/or maintenance. However, increasing cost pressures, longer equipment approval cycles, tighter service margins, and the move toward outcome-based medical insurance reimbursements are combining to make the capital expense model less attractive to health providers.

In addition, medical device vendors are interested in finding ways to make revenues more predictable as opposed to the inherently spiky revenue seen from large equipment sales.

Therefore, in recent years, the MedTech market has seen a shift away from the conventional capital expenditure model toward new innovative arrangements designed to give providers reduced upfront costs and more agile control over ongoing contracts, while also making medical device makers' revenues more predictable.

According to Med Device Online, "Many manufacturers are implementing innovative pricing models to lower buyer-side pressure. Some have developed shared savings contracts with hospitals, where they supply devices at a low price in exchange for a percentage of the revenue from using the devices."

Medical Device & Diagnostics Industry (MD+DI), says "Subscription models create a stronger bond and need for positive outcomes, not just another sale and another product on the shelf. The factors that make a relationship like this work are open communication of utilization and outcomes, willingness to share responsibility for quality improvements in products and hospital procedures, and an approach to product and service efficacy—not just a price-based mentality."

Challenges and Disruptive Trends in the MedTech Segment

Some of the key challenges in the medical device sector include:

- Traditional capital equipment procurement cycles have become too long and cumbersome

- Unanticipated disruptions such as the Covid pandemic have exposed the need for greater agility and rapid responsiveness in the health care sector

- Value-based insurance reimbursements are driving the need for justifying equipment and other devices according to outcomes and utilization rather than simply allocating capital acquisition costs

- Market dynamics and uncertainties are making revenues less predicable for MedTech manufacturers, thereby impairing forecasting and planning processes

- The shift from CAPX purchase models to subscription based offerings requires medical device manufacturers to adapt their revenue recognition and reporting systems to assure compliance

How DSE Applies to the Medical Device Sector

Digital Solutions Economy applications, along with overall digital transformation strategies, will play key roles in helping companies in the MedTech sector navigate these challenges.

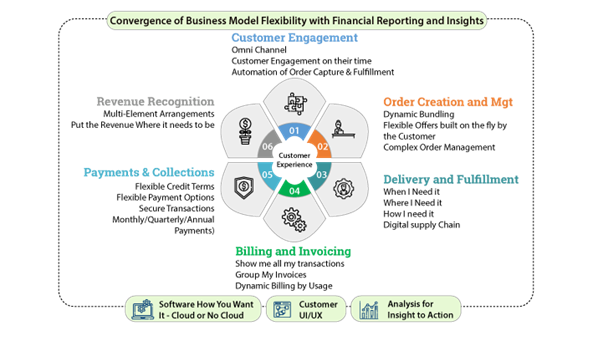

Solutions such as SAP Billing and Revenue Innovation Management (BRIM) enable medical device makers to smoothly transition from their equipment sales models to new subscription based offerings. As shown below, BRIM supports a holistic approach to DSE that seamlessly interfaces with third-party or legacy customer engagement systems on the front-end and also integrates directly with payments, collections and revenue compliance on the back-end.

Other related solutions in the SAP ecosystem are key to helping medical device companies make the transition to these new business models. For example, SAP Revenue Accounting & Reporting (RAR) and SAP Contract & Lease Management (CLM) streamline and simplify accounting and reporting of complex revenue streams under ASC 606 / IFRS 15 as well as asset management and accounting under ASC 842 / IFRS 16.

Other related solutions in the SAP ecosystem are key to helping medical device companies make the transition to these new business models. For example, SAP Revenue Accounting & Reporting (RAR) and SAP Contract & Lease Management (CLM) streamline and simplify accounting and reporting of complex revenue streams under ASC 606 / IFRS 15 as well as asset management and accounting under ASC 842 / IFRS 16.

Bramasol client, Hillrom, is a prime example of how new subscription-based models can be successful in the medical device sector. Hillrom's SmartCare™ service provides hospitals and clinics with turnkey management of their patient care equipment, such as beds, stretchers, diagnostics systems, test devices, consumables, etc.; to optimize readiness, availability, usage levels, locations, maintenance and remote device management.

Summary

As the overall health care landscape undergoes continuing change, the medical device sector in particular must cope with the need for new subscription based models that give health providers better ways to procure needed systems while also optimizing the ongoing usage and management of devices.

By embracing advanced Digital Solutions Economy capabilities, MedTech manufacturers can not only enhance their competitive standing by giving providers more flexibility; they also can improve their revenue predictability, increase loyalty and deepen ongoing partnering relationships.