As discussed in previous blog posts, The Digital Solutions Economy™ (DSE) is radically disrupting business models across many industries. These new engagement scenarios give customers more choices, with offerings like subscriptions, usage-based billing, entitlements, bundling of products with services, and other multi-faceted relationships.

This latest installment in our ongoing DSE blog series takes a step back with a holistic look at the entire order-to-cash process and explores how revenue accounting compliance can seamlessly integrate with DSE.

First, here's a quick look at the reasons so many companies are turning to using DSE business models, not only to drive revenue growth but also to improve key performance indicators (KPIs) across their financial processes.

While some companies have initially jumped into the DSE world by using third-party, subscriptions-focused, standalone applications, they have quickly run into limitations that prevent them from achieving these KPI and ROI results.

Limitations of typical subscriptions-only third-party applications include:

- Cannot scale quickly and lack flexibility to support growing business models

- Integration of new revenue streams takes too long

- Inability to adapt for complex bundling and multi-element DSE models

- Manual interventions needed for tracking and accounting for subscription revenues

- Lack of visibility across entire order-to-cash process

- Disparate data sources and systems increase reporting time and costs

- Compliance with ASC 606 / IFRS 15 requires separate cumbersome processes

To overcome these limitations, many market leading companies are leveraging SAP's Billing and Revenue Innovation Management (BRIM) solution to holistically innovate and scale recurring revenue-based order-to-cash processes.

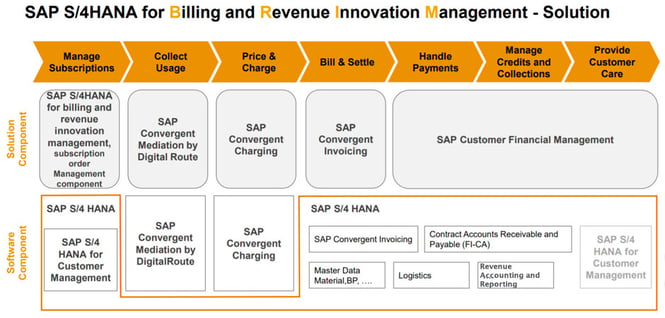

BRIM is actually more of a suite of interoperable solutions rather than just an application. As shown below, some of the key elements include:

- Subscription Order Management (SOM)

- Convergent Charging

- Convergent Invoicing

- Convergent Mediation for disparate data

- Integration with FI-CA, AR/AP and other financial management functions

All these elements of BRIM are optimally designed for integration within the overall S/4HANA ecosystem, as well as providing agnostic interoperability with many legacy or external systems, such as specially designed customer-facing front-end systems.

Integrating Revenue Recognition and Reporting Compliance with BRIM

One of the key advantages of using this SAP-enabled holistic approach is the ability to streamline integration of revenue recognition compliance with ASC 606 / IFRS 15. Although BRIM can handle some basic RevRec functions, most DSE business models are rapidly going "beyond basic" with the need to account for things like:

- Contract combinations

- Multi-element bundling of Performance Obligations (POBs)

- Complex allocations of revenue

- Multi-party revenue sharing models

- Integrated compliance for ASC 606 / IFRS 15 disclosures and reporting

In working with clients on implementing DSE models across a wide range of industries, Bramasol has collaborated with SAP on leveraging the inherent interoperability between BRIM and SAP Revenue Accounting and Reporting (RAR) to unify order-to-cash with RevRec compliance.

This enables clients to focus on optimizing their customer-facing DSE models while assuring that all the back-end complexity is seamlessly handled in a manner that scales and adapts to meet growth goals along with built-in revenue compliance.

How to Get Started?

Bramasol is offering a free 2-hour workshop to qualified prospects to help pinpoint key opportunities to optimize and transform your DSE subscription, usage or consumption based business models. Our team of experts can quickly identify low hanging fruit opportunities while recommending next steps. Whether you want to do it all at once or one step at a time, sign-up for your workshop session to see how we can help.

Click below to learn more: