Treasury executives are facing an unprecedented confluence of challenges today, with no reasonable prospect that the massive waves of change will be easing up any time soon. In addition to the black swan event of a global pandemic that has literally shutdown economic activity in much of the world, companies are also dealing with other high volatility forces, such as the Russia vs Middle East oil production standoff and global currency fluctuations.

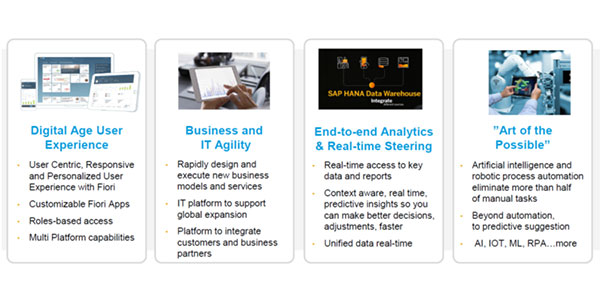

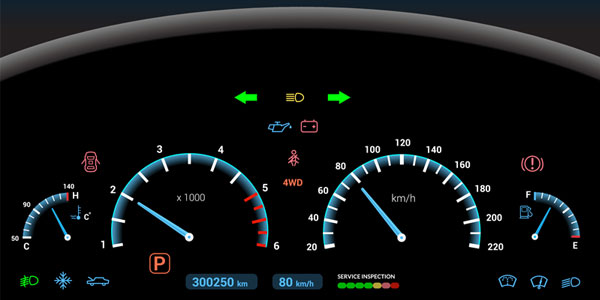

These and other related forces are combining to create significant new challenges for Treasury, which in turn is accelerating the already existing trend toward greater integration and interoperability of various treasury-related software applications. For example, management of cash positions, working capital and hedges against external risk factors are prime focus areas that can benefit from enterprise-wide visibility along with flexible analytics tools and agile response mechanisms.

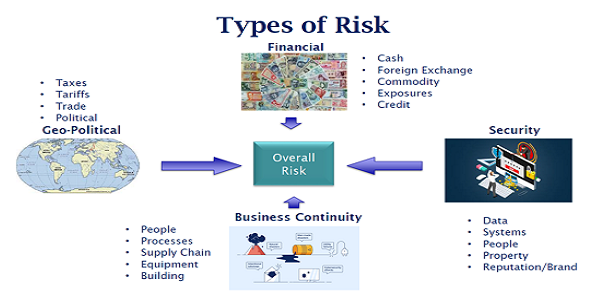

Overall risk management entails these four key areas:

- Financial: Cash, Foreign Exchange, Commodities, Exposures, Credit

- Geo-political: Taxes, Tariffs, Trade, Political

- Business Continuity: People, Processes, Supply Chain, Equipment, Real Estate

- Security: Data, Systems, People, Property, Brand/Reputation

Security issues span all aspects of a business. For more info, watch the video of this webinar on Risk and Exposure. In this post, we are focused on three areas, Financial, Geo-political, and Business Continuity, all of which have significant relevance to enterprise-wide treasury integration.

.jpg)