Working capital is the lifeblood of most organizations and, as such, it needs to be watched closely and managed in a comprehensive, real-time, and proactive manner.

All finance departments must manage working capital to keep their business operations running, while maintaining the agility to support the strategic goals and growth objectives of their business. Working capital management and optimization are key to assuring a business can maintain production, cover the cost of wages and supplies – and also have enough liquidity on hand to service their short-term credit obligations.

Any gaps are likely to be filled by external capital – usually at a higher cost than internally available funding. Being able to accurately measure and manage working capital, and avoid expensive external financing, can provide companies with an important competitive advantage.

Most CFOs use working capital as a key indicator of the operating health of the business. They focus on questions such as: Are we collecting our bills in a timely manner? Are we taking all the discounts that we are entitled to? Are we carrying too much inventory in our warehouses?

These basic metrics all have a direct impact on liquidity. However, the answers to these key working capital questions are inherently dynamic and constantly changing.

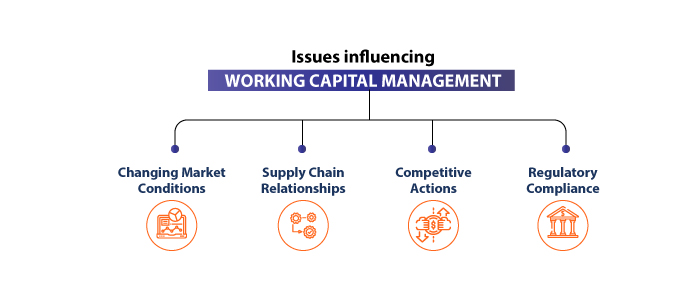

External forces, such as changing market conditions, supply chain relationships, competitive actions, and regulatory compliance issues are constantly influencing how working capital needs to be managed and leveraged to best advantage. At the same time, internal factors, such as increasing operational velocity, expanding global organizations, complex multi-country banking relationships and the move toward more out-sourced activities are making it more difficult to comprehensively manage working capital.

The key elements that constitute working capital include:

- Days Sales Outstanding (DSO) is the average number of days invoiced sales that are in the company’s receivables accounts.

- Days Payable Outstanding (DPO) is the ratio showing average number of days the company takes to pay its bills.

- Days Inventory Outstanding (DIO) is the average number of days that the company holds inventory before selling it.

- Cash Conversion Cycle (CCC) is a formula combining the above three factors to measure the length of time between the company’s purchase of inventory and receipt of cash from its sale.

Basically, these metrics enable CFOs and corporate management to see how long the company’s cash is tied up in its operations. In general, a shorter CCC indicates better working capital performance.

But the old days of simply managing working capital by deferring payments to vendors and accelerating collections from customers are not so easy anymore. In today’s globally diverse company organizations with complex supply chains and dynamically changing markets, management needs better tools for both seeing the big picture and also drilling down into the details of working capital across individual business units. Only by seeing the complete picture can companies optimize working capital both locally and globally, while bearing in mind the importance of all supplier and customer relationships.

The key to successful working capital management in today’s complex global environment is the use of highly integrated analytics processes and tools that can pull together real-time information from throughout the organization, with the agility and flexibility to drill-down and drill-through the specific detail for various business units. In addition to providing visibility into key metrics such as DSO, DPO, DIO and CCC, cash management analytics solutions should also support modeling of what-if scenarios to evaluate different working capital utilization approaches.

In summary, working capital management is critical to the health and success of every company. No enterprise can continue to exist without an adequate flow of working capital but why simply settle for “adequate”. Instead, forward-looking companies are discovering the hidden gold mines of value that can be leveraged by proactively and comprehensively managing their working capital across all levels of the organization.