All companies need to carefully manage their cash in order to ensure that sufficient funds are always available to support business operations, however, in today’s global enterprises, it can be difficult to maintain clear visibility and management of diverse cash repositories. This can be especially challenging when subsidiaries and other operating units maintain separate external banking relationships within their regional or local environments.

I’ve previously touched on related issues in blog posts on Working Capital Management and the need for a Global Approach to Cash Management. In this post, we are going to take a closer look at another key tool which is called In-House Cash Management.

So, what is “in-house cash”? Essentially, it is a process in which key cash management functions can be centralized within the treasury function, while still providing needed flexibility for diverse business units to locally manage their unique operational cash requirements.

Using advanced tools, such as the SAP In-House Cash application, companies can bring all of their intragroup payments within a central treasury function to minimize the risks of trusting critical payments to third parties. Instead of having much of the organization’s cash in external bank accounts, it is handled by the centralized “internal bank”.

The integrated in-house cash application enables easy set-up and management of multiple internal bank accounts to serve the needs of different operating units. From the perspective of the individual business units, these internal accounts function exactly like external bank accounts except that cash stays within a single centralized account.

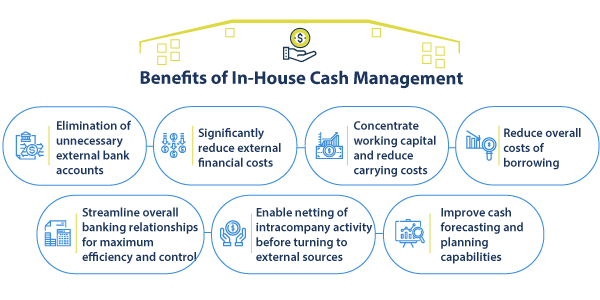

The key benefits of in-house cash include:

- Elimination of unnecessary external bank accounts

- Significantly reduce external financial costs

- Streamline overall banking relationships for maximum efficiency and control

- Enable netting of intracompany activity before turning to external sources

- Reduce overall costs of borrowing

- Concentrate working capital and reduce carrying costs

- Improve cash forecasting and planning capabilities

For example, consider a domestic company with a global organization that includes 4 to 5 legal entities in Europe and another 4 to 5 entities in the U.S., each of which is managing their own receivables and payables using an external bank. Each entity might have 10 people handling these processes, for a total of 80 to 100 staff. By transitioning to an in-house cash approach, the company could reduce the number of external bank accounts to only one centralized account or a few regional accounts, depending on specific country restrictions or legal requirements.

For simplicity, let’s assume that the company goes from 10 external accounts down to 1 central bank account. The in-house cash consolidation could potentially reduce staff requirements by as much as ninety percent. By eliminating the unnecessary staff time for supporting 9 external accounts, these valuable accounting resources can be reassigned to higher priority needs.

The company can process collections through the virtualized local accounts and provide all necessary financial tracking and reporting locally, while leveraging the benefits of centralized in-house cash. The SAP In-house Cash application can also handle a range of multi-currency requirements to support local and regional needs. In addition, centralized cash management streamlines responsiveness, simplifies processes and improves security.

In effect, using in-house cash provides significant savings and productivity improvements, while also enhancing cash visibility, forecasting and overall cash utilization. This enables companies to optimize their overall working capital management, reduce risk and enhance global competitiveness.

For more detail, listen to Bramasol’s Podcast

“In-House Cash Management Reduces External Bank Accounts, Improves Visibility and Boosts Productivity”