Last year and this year we've all been doing our fair share of binge watching as there's been plenty of content to keep us occupied.

.png)

Top most-watched webinars on Digital Solutions Economy

.png)

Jul 6, 2021

Jun 15, 2021

Jun 15, 2021

Jun 8, 2021

Jun 5, 2021

May 7, 2021

Apr 21, 2021

Mar 23, 2021

Mar 16, 2021

Tue, Jul 6, 2021 @ 03:56 AM / by John Froelich posted in webinar, SAP BRIM, subscription model, Digital Solutions Economy, DSE

Last year and this year we've all been doing our fair share of binge watching as there's been plenty of content to keep us occupied.

Tue, Jun 15, 2021 @ 09:13 AM / by David Fellers posted in CEO perspective, Thought Leadership, Hyperscaling

As part of Bramasol’s Comply, Optimize, Transform™ approach for serving both the near-term and long-term goals of our clients, we deal with a wide range of targeted process improvements spanning many financial systems of importance to CFOs and company leadership.

Tue, Jun 15, 2021 @ 06:14 AM / by Neeraj Dharia

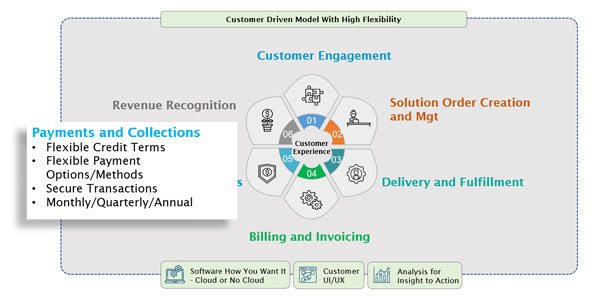

If you are a company in the consumer products space, I don't have to tell you about disruption from the new Digital Solutions Economy™ because you're already experiencing it. Either you're in an existing company who's market is being radically transformed by new "digitally born" upstarts, or you are a disruptor company looking for ways to scale up and dominate the established old guard companies.

Tue, Jun 8, 2021 @ 06:04 AM / by Bramasol posted in webinar, SAP, subscribtion model, SAP BRIM, solution economy, digital economy, Digital Solutions Economy

Watch Now our recently recorded webinar titled - Reduce Time to Market and Gain Insights for the Digital Solutions Economy with SAP Automated Revenue Management

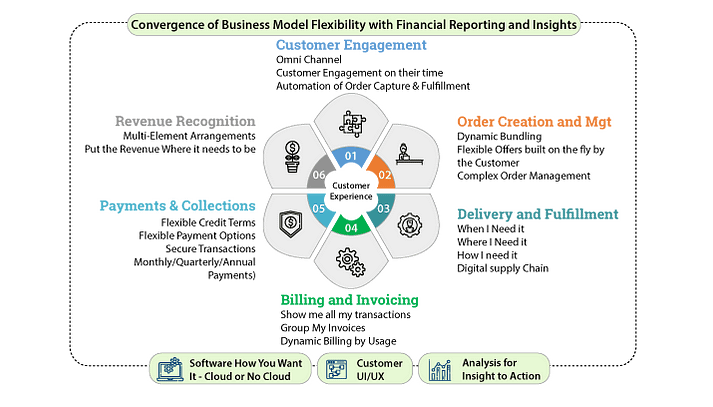

The new economy, the Digital Solutions Economy, requires agility, speed and insight.

In this first in a series of webinars on the Digital Solutions Economy, we explored with SAP's Pete Graham, how leveraging cloud-based technology to automate and simplify revenue accounting can reduce the time needed to introduce new offers to the marketplace, provide insights into revenue sources and profitability and drive improved ROI.

If you are moving to a recurring revenue model of any type, you cannot afford to miss this valuable discussion.

Fri, Jun 4, 2021 @ 05:04 PM / by David Fellers posted in CEO perspective, Thought Leadership, Digital Solutions Economy

This blog is part of an ongoing series on the Digital Solutions Economy™ (DSE). For additional context on DSE, please see my blogs on “The Digital Solutions Economy is More Than Just Subscriptions” and “Disruption is Happening in Consumer Products Companies. How Should You Deal with It?”

Fri, May 7, 2021 @ 06:39 AM / by David Fellers posted in Thought Leadership, Digital Solutions Economy

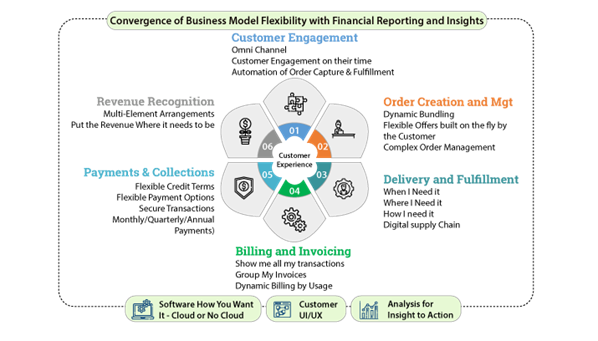

Companies throughout the world and across many industries are grappling with huge waves of change regarding how customers engage with them to purchase products and services. In a previous blog, we looked specifically at how disruption is happening in consumer focused companies and detailed the key issues in that particular market segment.

In this blog, we zoom out and look at the broader aspects and impacts of the Digital Solutions Economy that is now driving dynamic changes across almost every industry.

Wed, Apr 21, 2021 @ 05:05 AM / by Bramasol posted in SAP cloud-based, webinar, SAP, S/4HANA, solution economy, digital economy

Watch our recently recorded webinar on SAP RAR and Optimized Contract Management - Power for the New Digital Economy. SAP and Bramasol team discusses on how SAP Revenue Recognition's Optimized Contract Management can help power you into the Digital Economy.

With powerful features such as day-based calculations, improved inbound processing and new reporting, OCM is the way to go. SAP's product development and Bramasol, the leaders in SAP Revenue Accounting will discuss and present cases for the use of Optimized Contract Management.

Tue, Mar 23, 2021 @ 04:11 PM / by David Fellers posted in CEO perspective, Thought Leadership, shared services

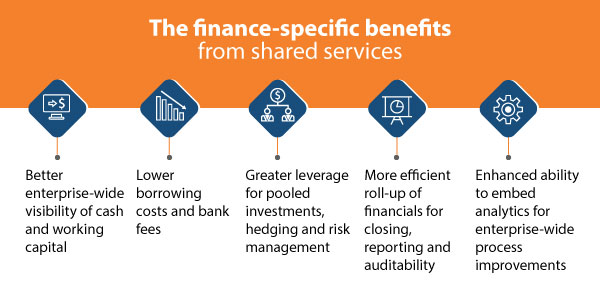

As today’s globally competitive landscape requires companies to tailor their organizations to be more responsive to local and regional market and customer requirements, they also must deal with increasing challenges for enterprise-wide integration and efficiency.

Tue, Mar 16, 2021 @ 02:41 AM / by Bramasol posted in SAP cloud-based, webinar, SAP, S/4HANA, Treasury Management, Treasury Solution, working capital

Working capital is one of the top tools to manage and improve Cash Flow. With SAP's S/4HANA finance and treasury solutions you can have real-time access to the data and insights you need to improve working capital.

Join Bramasol's Julio Dalla Costa (Director of Technical Accounting) , and SAP's Haresh Chhaya to learn how to target Days Sales Outstanding, Days Payables Outstanding and the Currency Conversion Cycle to pinpoint targets for improvement.

Watch now our recorded webinar on March 30, 2021 - 10 AM PDT / 1 PM EDT if you want to know how you can gain visibility into Working Capital with the world's leading ERP software, you can't afford to miss this.