Companies faced with the lease accounting compliance deadlines over the past 2-3 years opted for “quick and easy” standalone or offline approaches that emphasized basic compliance over long-term integration, efficiency, and scalability.

As a result, most of these companies are now grappling with major roadblocks when it comes to managing lease accounting compliance in relationship to overall business goals, especially when it comes to coping with dynamically changing lease portfolios.

One of the biggest shortcomings from taking the standalone solution approach is the narrow focus on cataloging existing lease portfolios and analyzing them against the new compliance criteria. In effect, this is like just taking a static snapshot of a constantly changing environment.

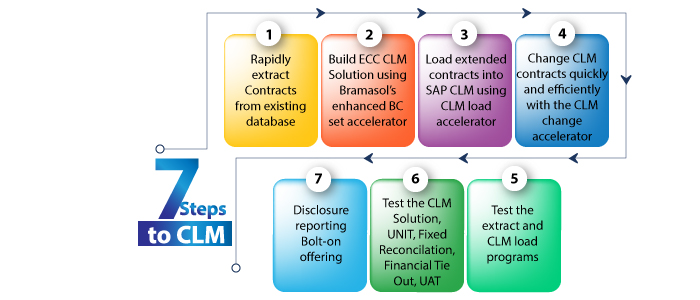

So, how can you overcome these shortcomings related to standalone or offline approaches?