If you're planning to attend SAP Insider Financials 2016, Bramasol is happy to help you SAVE $200 on your registration! Simply click here or on the image below.

SAP Financials 2016: Save $200 on Your Registration

Feb 10, 2016

Feb 8, 2016

Feb 2, 2016

Jan 28, 2016

Jan 26, 2016

Jan 14, 2016

Jan 12, 2016

Jan 5, 2016

Dec 17, 2015

Wed, Feb 10, 2016 @ 03:02 PM / by Bramasol RevRec Team posted in Revenue Recognition

If you're planning to attend SAP Insider Financials 2016, Bramasol is happy to help you SAVE $200 on your registration! Simply click here or on the image below.

Mon, Feb 8, 2016 @ 09:00 AM / by Bramasol RevRec Team posted in Revenue Recognition, SAP Revenue Accounting and Reporting, SAP RAR

Bramasol, the leader in SAP Revenue Recognition, is now offering SAP RAR in the Cloud Solutions to help you get Rev Rec projects up and running quickly.

Tue, Feb 2, 2016 @ 06:00 AM / by Bramasol RevRec Team posted in Revenue Recognition, SAP Revenue Accounting and Reporting, revrec hot-tips

View RevRec as an Opportunity to Transform and Improve Processes

The extent of impacts will vary by industry and by organization within the industry, but all companies will be impacted. Some of the changes this will cause include additional or expanded disclosures, the inclusion of additional estimates and judgments in external Financial Reporting, and most likely new or modified business processes and controls.

It is important to note the last impact item from above: new or modified business processes and controls. The new standard is not just an accounting exercise, but rather extends well past technical accounting into core business processes.

To get lots of detail on how to leverage these opportunities,, click here to read Larry McKinney's blog post "Revenue Recognition Projects: Driving Transformational Actions" on LinkedIn Pulse.

Read all of the RevRec Ready Hot Tips here.

Thu, Jan 28, 2016 @ 05:48 AM / by Jenit Parmar posted in Revenue Recognition, RevRec 5-Step Model

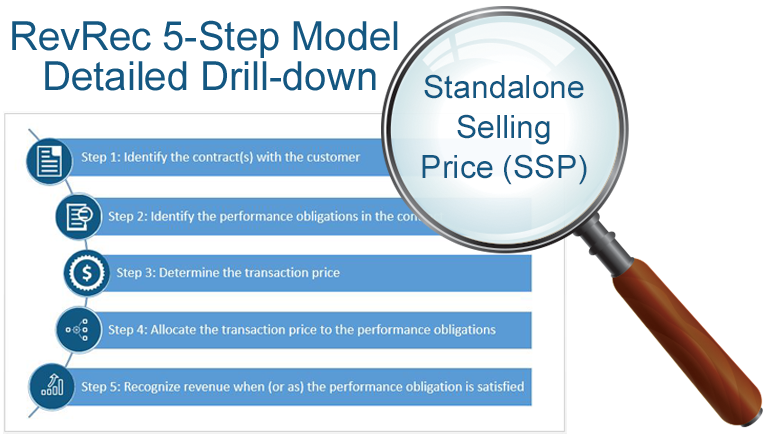

In the Five Step Revenue Recognition process, Step Four requires that entities allocate the Transaction Price to each Performance Obligation (POB) based on its relative Standalone Selling Price. The Standalone Selling Price is the price at which the entity would sell a good or service separately to a customer.

Tue, Jan 26, 2016 @ 06:09 AM / by Asit Gosalia posted in Revenue Recognition, RevRec 5-Step Model

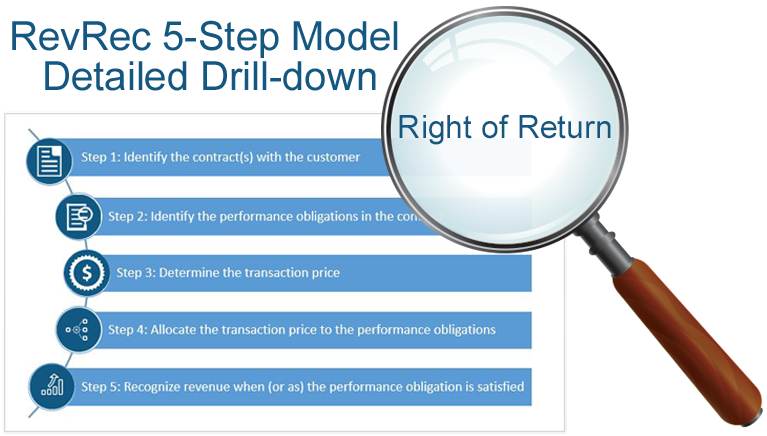

Depending on the contract terms and conditions of a sale, products that have been sold by a seller to a buyer may have a potential Right of Return. The potential return of merchandise by a customer must be accounted for in accordance with GAAP (Generally Accepted Accounting Principles) whenever a buyer has a future Right of Return. This may be in accordance with formal or informal agreements between buyer and seller.

According to revenue recognition regulations, when a Right of Return exists, a seller may or may not be able to recognize all of the revenue at the time of sale.

Thu, Jan 14, 2016 @ 06:16 AM / by Hans Christian Metz posted in Revenue Recognition

Last month, FASB and the International Accounting Standards Board (IASB) reaffirmed amendments they had previously proposed to in order to clarify principal vs. agent guidance in the new, converged revenue recognition standard (See more detail at Journal of Accountancy).

Tue, Jan 12, 2016 @ 02:50 PM / by Larry McKinney posted in Revenue Recognition

I have received a plethora of questions from people who read my last post, Revenue Recognition Changes are Coming: Make 2016 Your RevRec Year-of-Action, but the most common theme was: “how do I get started?”

Tue, Jan 5, 2016 @ 01:16 PM / by Larry McKinney posted in Revenue Recognition

Thu, Dec 17, 2015 @ 03:51 PM / by Larry McKinney posted in Revenue Recognition, SAP Revenue Accounting and Reporting

Revenue Recognition changes are coming quickly and many companies have already begun to evaluate what compliance with the new standards means to them. Some companies still have to evaluate the impact…to those companies I say the time is now. The new Revenue Recognition guidelines take effect January 1, 2018 and the date is rapidly approaching.