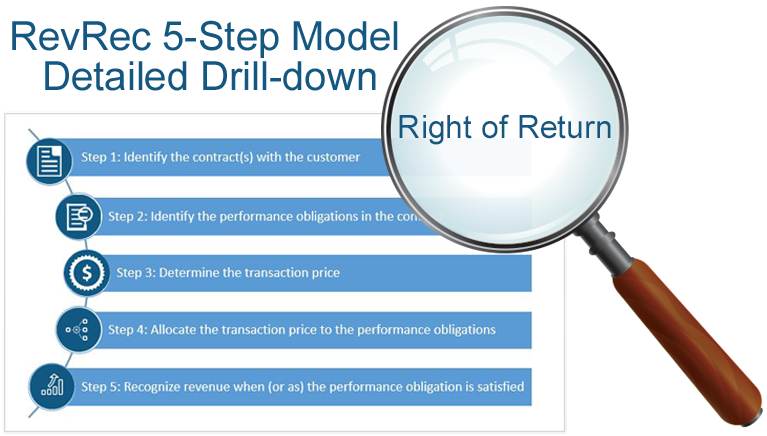

What you need to know about Right of Return

Depending on the contract terms and conditions of a sale, products that have been sold by a seller to a buyer may have a potential Right of Return. The potential return of merchandise by a customer must be accounted for in accordance with GAAP (Generally Accepted Accounting Principles) whenever a buyer has a future Right of Return. This may be in accordance with formal or informal agreements between buyer and seller.

According to revenue recognition regulations, when a Right of Return exists, a seller may or may not be able to recognize all of the revenue at the time of sale.