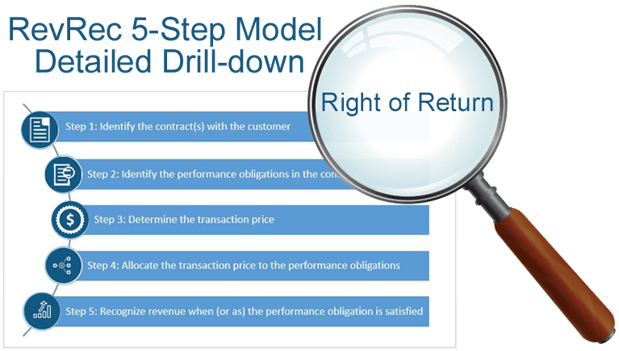

What you need to know about Right of Return

Depending on the contract terms and conditions of a sale, products that have been sold by a seller to a buyer may have a potential Right of Return. The potential return of merchandise by a customer must be accounted for in accordance with GAAP (Generally Accepted Accounting Principles) whenever a buyer has a future Right of Return. This may be in accordance with formal or informal agreements between buyer and seller.

According to revenue recognition regulations, when a Right of Return exists, a seller may or may not be able to recognize all of the revenue at the time of sale.

Generally, the seller can record the sales revenue at the time of sale if the seller is able to estimate the rate of product returns. The estimated product return allowances should then be recorded at the time of sale as well. However, if the seller is unable to make a reasonable estimate of the amount of future product returns, the seller should wait to record revenue until the loss can be estimated or the return privilege expires.

Some factors that may contribute to not being able to make a reasonable estimate of product returns include:

- A lengthy period for product returns

- Lack of experience with product returns (e.g., new product, new market)

- Few significant sales with unique terms

- Product susceptibility to obsolescence

- Newness of the product

- Introduction of new products which could lead to high returns of current products

- Introduction of superior products by competitor(s)

- Channel stuffing (significant inventory level increases in distribution channels)

Example of Right of Return estimation process:

Entity A is a manufacturer and distributor of running apparel and shoes. Entity A distributes its products through national and local retail stores. It has determined, based on historical experience, that it has four transaction pools for estimating returns.

- National – Apparel, 6%

- Local – Apparel, 7 %

- National – Shoes, 5 %

- Local – Shoes, 7%

Entity A enters into an arrangement with Local Retailer B to sell 50 pairs of running shoes at $50 per pair and 50 sets of running shorts and shirts at $40 per set. The merchandise is shipped freight on board (FOB) shipping point and the payment terms are Net 30 days. Returns, if any, must be made within 120 days.

Revenue should be recognized net of an allowance for estimated returns at the time of sale because (1) the price of the goods is fixed at the date of sale, (2) Entity A has no further obligation with regard to the resale of the goods, (3) Local Retailer B’s payment to Entity A is not dependent upon resale of the goods, and (4) Entity A can reliably estimate the amount of returns based on a large pool of similar historical transactions.

Entity A would record an allowance based on the estimated returns for the local retail pools at the time revenue is recognized using the calculation as follows:

$175 (7 percent of $2,500) for shoes and $140 (7 percent of $2,000) for apparel

Example of Inability to estimate Right of Return:

Entity A is a manufacturer and distributor of running apparel and shoes. Entity A has historically distributed its products only through national retail stores. Entity A expands distribution to include various local retailers as well. Entity A enters into an arrangement with a NEW Retailer D for the sale of 50 pairs of running shoes at $50 per pair and 50 sets of running shorts and shirts at $40 per set. The merchandise is shipped FOB shipping point and the payment terms are Net 30 days. Returns, if any, must be made within 120 days of the date of shipment.

Since the retailer D is a new type of customer, Entity A cannot use historical information relating to the transactions with national retail stores in order to estimate returns from Local Retailer D. Because Entity A cannot estimate returns from Local Retailer D, it should defer all revenue related to the sale until the return period lapses.

In SAP RAR 1.1, there is functionality and capability to handle both of the above scenarios. To know more about it, please reach out and contact us via the link below.