Things you Need to Know About SSP:

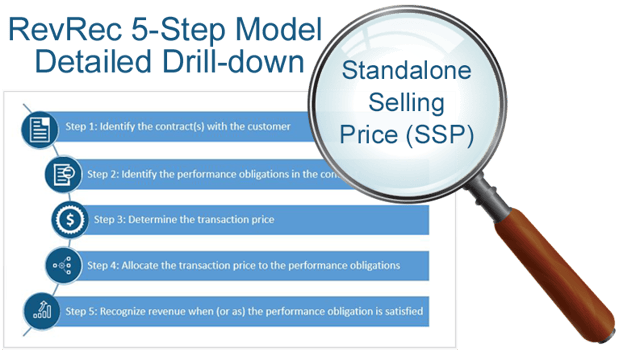

In the Five Step Revenue Recognition process, Step Four requires that entities allocate the Transaction Price to each Performance Obligation (POB) based on its relative Standalone Selling Price. The Standalone Selling Price is the price at which the entity would sell a good or service separately to a customer.

As per the New Revenue Standard, all Standalone Selling Prices need to be estimated if the selling price is not readily available. The estimation method used should be consistently applied in similar circumstances and it should include as much available information as possible, including Market Conditions and entity/customer specific factors. However, Accounting Standard Codification (ASC) 606 provides three standard methods to estimate the Standalone Selling Price as listed below:

1. Adjusted Market Assessment Approach

The Adjusted Market Assessment Approach method estimates Standalone Selling Price by estimating the price that the customer would pay for the Good or Service in the entity’s market. This method includes reference to the prices that an entity’s competitors charge for similar goods or services adjusted to reflect the entity’s costs and margins.

2. Expected Cost Plus Margin Approach

Under the Expected Cost Plus Margin Approach method, the entity estimates Standalone Selling Price by estimating expected cost to satisfy the Performance Obligations and then adding an appropriate margin. This approach would be more useful when demand for the good or service is unknown and/or the fulfillment costs are clearly identifiable.

3. Residual Approach

Under the Residual Approach method, Standalone Selling Price is estimated by subtracting the sum of all observable Standalone Selling Prices of other goods or services promised from the total transaction price. The Residual approach can only be used if one of the below criteria is met:

- There is a wide variety of prices for the same good or service to multiple customers.

- The good or service has never been sold previously on a standalone basis and there is no established price for that good or service.

This approach needs to be used at a lower priority and companies should first attempt to utilize another acceptable method to get a reasonable estimated Standalone Selling Price.

The Standalone Selling Price needs to be determined at the outset of the contract regardless of the approach used. The management team should consider all available information and maximize observable inputs to identify the most suitable approach to use. If there is no observable Standalone Selling Price then a company can use a combination of approaches to determine Standalone Selling Price for each Performance Obligation.

In summary, the Revenue Standard ASC 606 provides a clear picture to determine Standalone Selling Price based on three standard approaches and it also simplifies the process to determine Standalone Selling Price.

In the Revenue Standard, the non-observable price hierarchy has been removed to allow any reasonable estimation method. To further simplify the process, it has also removed the need for Industry-specific guidance on Standalone Selling Price and now with the New Standard the same guidance applies for all Industries.

Lately, we've been seeing an upswing of clients asking questions about Standalone Selling Price (SSP). To refresh your understanding of SSP, Julio Dalla Costa, Bramasol's put together this short 7-minute update on the key considerations for calculating and accounting for SSP.

Click below to watch the Hot-tip video on SSP.

To learn more on Standalone Selling Price Optimization with SAP RAR, watch our recently recorded webinar. Hear from our experts on how this tool can benefit your SSP process and reduce the time required to manage it across multiple revenue streams.