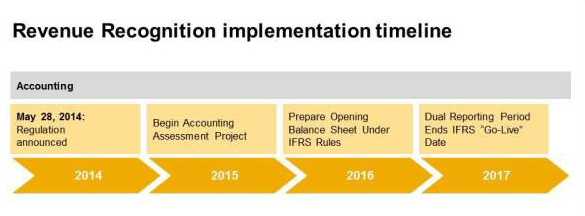

When January 1, 2017 arrives, companies across all industries that follow US GAAP and IFRS rules will be required to comply with the new five-step model for revenue recognition. On May 28, 2014, the FASB and the International Accounting Standards Board (IASB) issued converged guidance on recognizing revenue in contracts with customers. The process calls for implementation during 2016 and “go live” reporting under the new standards in 2017.

Unlike the previous revenue accounting standard that was industry-specific and transaction-specific, the goal of the FASB and the IASB in the new standard is to introduce uniformity and predictability to revenue recognition practices. Among the industries that are likely to experience significant changes are aerospace, asset management, construction, real estate, software and telecommunications. Changes won’t be limited to these industries, therefore all companies need to develop an implementation plan.