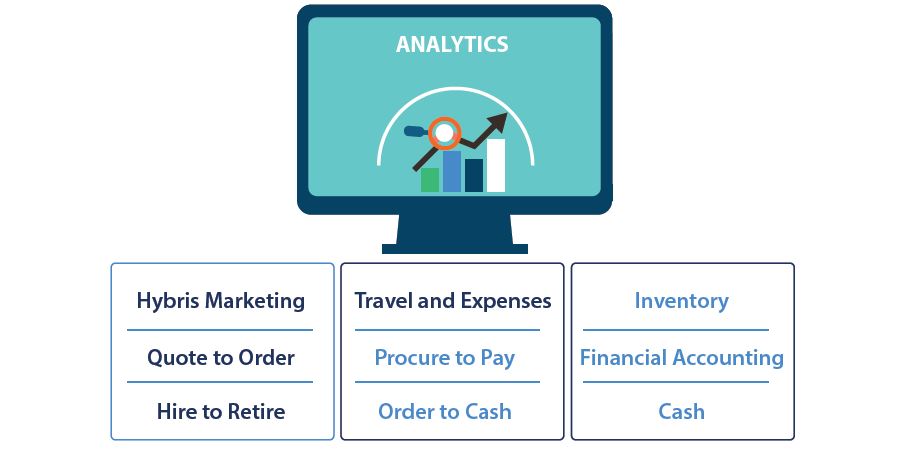

Most companies are continuously dealing with pressures to keep up with changes in their external marketplaces, competitive landscapes, customer needs, and investor expectations. These external issues are also driving internal pressures to improve efficiency, productivity, agility, security and enterprise-wide alignment and integration.

When it comes to S/4 HANA - Using a Fit-to-Standard Approach Enables a Fit-for-Innovation Mentality

I am pleased to announce and introduce you to our new CFO,

I am pleased to announce and introduce you to our new CFO,