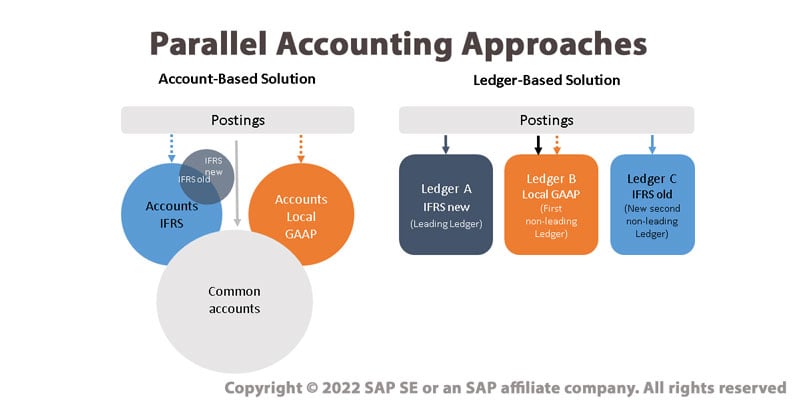

One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. For example, a company with branches doing business in the United States and the European Union will need to comply with both GAAP and IFRS accounting principles. They also likely will face different taxation structures for specific countries or even local jurisdictions.

Furthermore, these challenges are not a "one-off" proposition because the need to serve disparate accounting and reporting requirements repeats itself for every periodic closing process including monthly, quarterly and annual reporting.