One important side effect of the ongoing trend toward globalization is the need to comply with a range of different accounting principles as well as with disparate reporting and compliance mandates. For example, a company with branches doing business in the United States and the European Union will need to comply with both GAAP and IFRS accounting principles. They also likely will face different taxation structures for specific countries or even local jurisdictions.

Furthermore, these challenges are not a "one-off" proposition because the need to serve disparate accounting and reporting requirements repeats itself for every periodic closing process including monthly, quarterly and annual reporting.

Trying to accomplish disparate reporting with spreadsheets or other external methods is inherently problematic, expensive and slow. Likewise, attempting to run each subsidiary as a standalone entity makes it difficult to roll-up all the entities into a unified enterprise-wide view. Ideally, companies need to have accounting systems that can both adapt to different regulations and seamlessly provide visibility and analytic capabilities across the entire enterprise.

SAP addresses these challenges through a Parallel Accounting approach that offers flexibility to integrate multiple subsidiaries using either an account-based or a ledger-based approach. As one of SAP's longest serving partners in the financial and compliance arena, Bramasol helps global clients navigate the optimization of Parallel Accounting and integration of disparate reporting requirements.

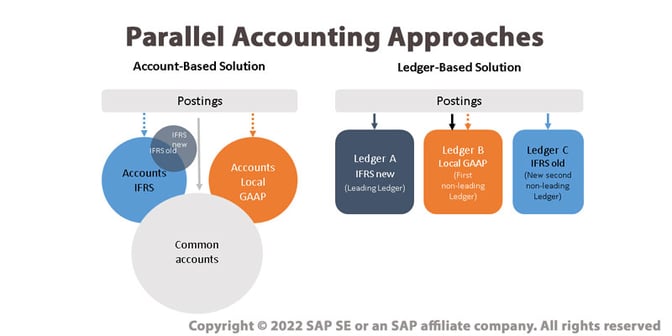

Basically SAP's Parallel Accounting can be implemented using either of these two options:

- Parallel Accounts - in which multiple accounting principles are assigned to the leading ledger

- Parallel Ledgers - in which multiple ledgers are used, with an accounting principle applied to each ledger

The account-based approach uses account logic identifiers to assign accounting principles, such as using unique prefixes to determine which accounts use IFRS vs GAAP principles. In contrast, the ledger-based approach groups all accounts for a particular principle into a non-leading ledger, with all non-leading ledgers then rolling up into a single Leading Ledger.

Either method enables companies to perform valuations and closing preparations for particular company codes according to required accounting principles for specific countries or locales, while still maintaining the ability to roll-up everything for enterprise-wide management.

The choice of which approach to use depends on a variety of factors such as the number of accounts or ledgers that are needed for managing multiple entities within the overall organization. Other key factors include where the company stands with regard to implementing new accounting standards (ASC 606, IFRS 15, ASC 842, IFRS, 16, etc.) and also the status of their overall digital transformation journey and migration to SAP S/4HANA.

Seamless integration with the full scope of SAP applications is key to the successful implementation and ongoing operation of Parallel Accounting. Within the SAP ecosystem, Parallel Accounting is supported by the following financial application components:

- Financial Accounting (FI)

- Asset Accounting (FI-AA)

- Treasury and Risk Management (TRM)

- Controlling (CO)

- Inventory Accounting (MM and ML)

Thousands of companies already rely on SAP's ERP systems for managing multiple sets of books in parallel to satisfy various reporting, compliance and other legal requirements for their financial statements across different jurisdictions.

Looking ahead, the migration to SAP S/4HANA holds promise for even more effective and easy to manage Parallel Accounting as the new in-memory architecture and Universal Journal concept will boost both performance and consistency of data structures.

Accelerated adoption of SAP S/4HANA was previously identified as one of our Key Trends to Watch in 2022, and it also offers an excellent opportunity for enhancing the use of Parallel Accounting across all entities within global enterprises.

With the Universal Journal providing a solid foundation, all the financial data that had been distributed across multiple tables and systems is unified in one place. This enables consistent parallelism across all sub-ledgers and value flows, giving rise to the concept of "Universal Parallel Accounting".

Building on our proven leadership in compliance applications, financial management, treasury, and building finance-specific solutions, the Bramasol team is well positioned to help companies implement Parallel Accounting processes today that provide rapid ROI while at the same time charting a roadmap for moving into even greater payback within the S/4HANA enabled Intelligent Enterprise,