As detailed in numerous previous blog posts in this series, the Digital Solutions Economy™ (DSE) is creating sweeping change and new opportunities for companies in a wide range of markets.

This episode focuses on how DSE business models present new challenges with regard to Financial Planning & Analysis (FP&A) processes, which require enhanced agility, scalability and end-to-end integration to handle DSE's inherently dynamic requirements.

Gartner defines FP&A as "a set of four activities that support an organization's financial health: 1) planning and budgeting, 2) integrated financial planning, 3) management and performance reporting, and 4) forecasting and modeling."

How DSE Models Impact FP&A Focus Areas:

All four of these FP&A areas are undergoing huge change as companies move to offering subscription-based DSE products and services. The following sections provide a brief look at the impacts of DSE in each area.

Planning & Budgeting - DSE's shift toward subscription-based offerings offers benefits in making revenue streams more predictable, with fewer peaks and valleys. However, the shift toward giving customers more control over dynamic changes to their accounts, such as bundling or adding/removing services, presents new challenges for planning and budgeting.

Integrated Financial Planning - This is where a move toward real-time visibility and analysis of data becomes critical with dynamically changing DSE scenarios. It's no longer sufficient for businesses to just have accurate data. In today's world, they need accurate and up-to-date data that tracks continuous changes at both the detailed customer transaction level and overall aggregate business analysis level.

Management and Performance Reporting - Integrated dashboards, analytics, and disciplined reporting methods are vital tools for both C-level decision-makers and frontline operational managers to stay ahead of emerging trends in their DSE programs, as well as providing a cost-effective mechanism for timely compliance reporting.

Forecasting and Modeling - Experience thus far has shown that new DSE subscription-based offerings not only disrupt external markets; they also disrupt internal forecasting methods. Putting customers in charge of bundling and other changes as well as choosing payment timing and methods, means there are many more moving parts in the forecasting process. Add in the rapid scalability and high data Volumes, Velocity, Density and Complexity inherent to DSE and it becomes clear that forecasting and modeling needs to be more robust.

How to Improve FP&A Effectiveness for DSE:

The primary key to making FP&A more robust for the Digital Solutions Economy will be to enhance the end-to-end integration of FP&A elements throughout all DSE processes.

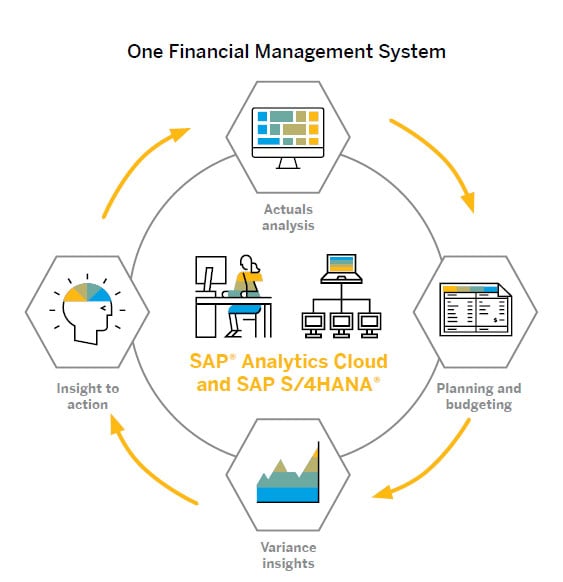

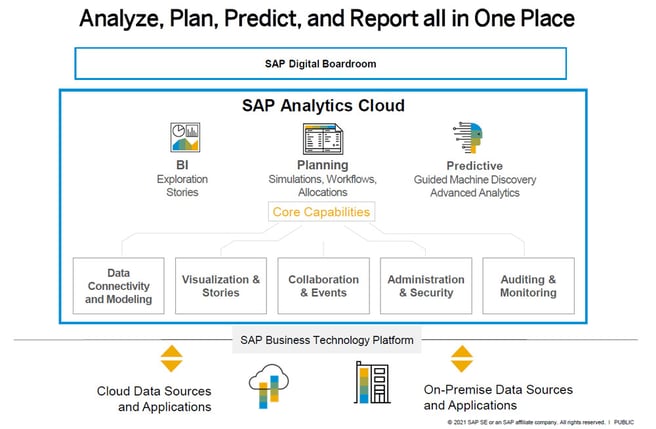

Within the SAP ecosystem, SAP Analytics Cloud (SAC) has become an important unifying capability for pulling together disparate information from both SAP and non-SAP applications, giving users the ability to analyze, plan, predict and report all in one place.

By integrating directly with the SAP Business Technology Platform (BTP), SAC provides seamless analytics for the full spectrum of FP&A focus areas, including Planning & Budgeting, Financial Planning, Reporting, and Forecasting/Modeling.

SAC enhances real-time connectivity and visualization to help users identify and understand rapidly changing factors in their DSE environments, with full drill-down and drill-through capabilities to see both transaction level detail and macro level trends. This not only enhances planning and collaboration to support rapid response to changing conditions; SAC also enables predictive analytics to model future trends and opportunities.

Bramasol has deep expertise with integrating SAC to manage Revenue Recognition, Lease Asset Management, Treasury, and other finance related functions. Several of our key value-added packages, such as RevRec and Lease Accounting disclosure and reporting applications have been built using SAC functionality. Based on this extensive experience, we have also standardized on using SAP Analytics Cloud in all our BRIM-enabled projects for the Digital Solutions Economy

Not only does this approach help integrate FP&A functionality into new DSE offerings; because SAP Analytics Cloud is a seamless part of SAP S/4HANA, it also streamlines and defines the forward roadmap for future digital transformation within the Intelligent Enterprise.