When it comes to risk management, CFOs are invariably at the center of the action. This is especially true during a black-swan event such as the current global pandemic but even in normal times, CFOs must deal with identifying and mitigating risk every day.

Among the key tools that CFOs use in risk management are hedging strategies, particularly regarding foreign exchange (FX) rates and portfolio investments. This blog provides an overview of hedging strategies, methods and technology tools that can help CFOs mitigate risks while optimizing returns.

The concept of “hedging” is not a new idea. It

has actually been around since the 1600s when the term was coined to describe a method of “fencing in” one’s risk in much the same way that physical hedges were used to enclose a piece of land. In today’s parlance, hedging has typically come to mean “buying an investment that is designed to reduce the risk of losses from another investment.”

Whether it involves FX currency rates or investments, hedging basically means taking counter-balancing positions that effectively put a limit on the amount of loss than can be experienced in your primary cash or investment position. There is typically an inherent cost to hedging in that you are also limiting your potential upside gains but the benefits of avoiding big losses are determined to be worth it.

In fact, although we don’t typically think of it as hedging, buying an insurance policy is a classic example of this approach. You are willing to pay the recurring premiums in order to cover your downside from potential losses. In theory, you could save money by not buying insurance because you’d avoid paying all those premiums, but it only takes one uninsured disaster to show how foolhardy it can be to live without insurance policies.

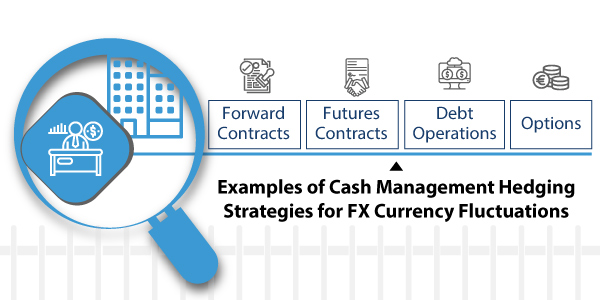

Some examples of cash management hedging strategies for FX currency fluctuations include:

- Forward Contracts that specify an amount, exchange rate and future date for a currency exchange between two parties. This allows the parties to conduct business, close deals and ship orders at current FX rates with practically no risk of fluctuations. The only real risk is either party failing to comply.

- Futures Contracts are financial instruments that pre-define a currency exchange with a specified amount, rate, and expiration date. They are on the market and typically can be traded like other financial instruments, which eliminates the non-compliance risk of forward contracts but with less flexibility for customizing the terms.

- Debt Operations involve borrowing foreign currency in the amount they expect to receive in the future and then exchange it into local currency and deposit it, thereby hedging against exchange rate fluctuations. When they receive the expected foreign currency, they use it to pay the debt. However, if the local interest is not enough to pay the loan's interest, this can be expensive.

- Swaps are contracts between two parties that need foreign currency but don’t want to borrow from a foreign bank. The parties using different currencies exchange an initial amount and gradually swap back small amounts as interest and at the end of the contract, they return the initial amounts. This gives both parties the ability to access foreign currency without taking a loan in that currency.

- Options are contracts that enable companies to buy or sell currency at specified rates up until a predetermined expiration date by paying a preset premium. This locks in the rate for duration of the contract, along with the option to rescind the contract if interest rates turn favorable and then they only pay the preset premium.

Regardless of the specific hedge strategies employed, CFOs also need comprehensive tools that integrate hedging functionality with global cash management strategies, payment factory functions and in-house cash management repositories.

For example, SAP Hedge and Risk management tools are natively integrated to SAP and to the broader SAP Treasury ecosystem, as well as with external resources such as Bloomberg for information or the 360T trading platform. This enables CFOs to plan and implement their specific hedging strategies while benefiting from end-to-end visibility into enterprise-wide cash, commodity or finance instrument positions and leverage advanced analytics to assure that risk mitigation tactics stay on track and produce the intended results. All of this can be handled without ever having to leave SAP and log into separate systems.

For more info on risk management, download this webinar video “Managing Risk and Exposure”