Merger and Acquisition (M&A) activity provides an important strategic element for many companies that can help boost growth, open new markets and enable economies of scale for driving profitability. Over recent decades, there has been a steady upswing in the usage of M&A exemplified by increases in the number and size of deals, along with an expanding range of different types of deals.

According to Deloitte’s 2020 M&A Trends Report, “Deal-makers anticipate M&A activity will continue at an active pace in 2020, extending the prolonged boom in deals that has resulted in more than $10 trillion in domestic transactions since 2013.”

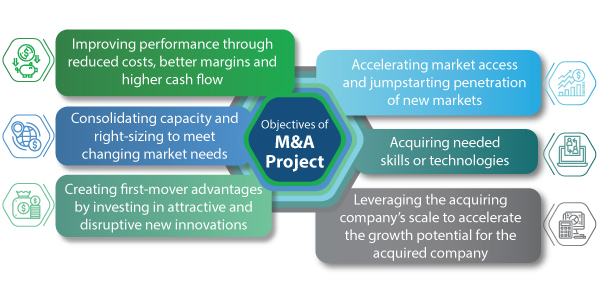

Some specific objectives of M&A projects include:

- Improving performance through reduced costs, better margins and higher cash flows

- Consolidating capacity and right-sizing to meet changing market needs

- Accelerating market access and jump-starting penetration of new markets

- Acquiring needed skills or technologies

- Leveraging the acquiring company’s scale to accelerate the growth potential for the acquired company

- Creating first-mover advantages by investing in attractive and disruptive new innovations

In general, these objectives fall into two major categories: 1) “Scale” deals that involve a high degree of business overlap with a focus on fueling market share expansion, reducing costs and improving profits, and 2) “Scope” deals between disparate companies where the focus is more on exploiting new markets, diversifying products or services, driving innovation and leveraging new disruptive business models.

While M&A is an attractive strategy for many companies, there are numerous challenges when it comes to making an M&A deal ultimately successful. Because so many of the issues surrounding M&A success are financial in nature, CFOs and their staff are invariably are at the center of the action and largely responsible for helping drive successful outcomes.

Following are some of the key areas where the Office of the CFO plays a critical role in M&A.

Pre-Merger Due Diligence

Mergers and acquisitions require significant upfront due diligence by the buyer, before committing to the transaction. The buyer needs to know what it is buying, what obligations it is assuming, the nature and extent of the seller’s contingent liabilities, any problematic contracts, litigation risks, intellectual property issues, and much more. This is particularly true in private company acquisitions, in which the seller has not been subject to the scrutiny of the public markets.

Closing Activities and Accounting Transition Plans

CFOs typically also have the lead role to account for merged assets, cash flows, consolidated revenues, contracts in flight, and any deal-specific settlement agreements. This process includes identifying the differences in existing accounting and operational processes between the merged entities and formulating specific plans for what should be consolidated and what can best be kept separate. A key factor in this effort is assuring that relevant compliance and reporting requirements are addressed.

Integration of ERP, Finance and Accounting Systems

One of the most important factors for a successful M&A business deal is aligning and integrating the merged entities’ finance, ERP and accounting systems in a way that both maximizes operational agility for the business units and enables enterprise-wide visibility, analytics and control. In most M&A cases, the merged entities have different legacy systems and processes, frequently with lots of customization that has been implemented over time, so it can be quite a challenge to consolidate financial controls, reporting and decision-making processes.

In these situations, it often can be useful to leverage new “agnostic connector-technologies”, such as SAP Central Finance, Cloud Analytics, and Cash Management applications, that integrate disparate systems for analytics, visibility and reporting while preserving the ability to run operational processes in legacy environments with drill-down capabilities to seamlessly access transactional detail when needed.

It also is important to keep an eye toward the future needs of the merged entities so the overall finance and ERP technology stack can be aligned to achieve the ultimate goals of the M&A deal. For example, if a traditional product-focused company is acquiring a smaller company to expand its scope into subscription-based offerings, the CFO’s office must play a key role in researching and implementing flexible high-volume billing solutions to support the new business model.

In summary, M&A can yield excellent results for accelerating growth, expanding markets and leveraging new organizational synergies – especially when the process is well managed. By leveraging disciplined accounting practices with a comprehensive view of optimizing finance and business processes, the Office of the CFO can make the difference between M&A projects that fall short and those that meet and surpass expectations.

For more info:

Read the ebook: Accounting and Financial Considerations for M&A Success

Register for upcoming webinar on Technical Accounting Issues for M&A Success