Treasury functions are not easily isolated from the rest of operational applications that are typically spread throughout an organization – nor should they be. In fact, almost all treasury processes can benefit greatly from becoming more integrated with other business processes.

However, all too often, companies are enticed by the promises of standalone treasury and risk management applications that claim to be inter-operable but fall short of providing true seamless integration with core ERP business and finance applications.

The strategic importance of treasury has been increasing steadily in recent years, thereby leading to a proliferation of new capabilities from both standalone application vendors and broad-based ERP/finance systems providers.

Companies are also coming under more pressure from shareholders and regulators to increase their transparency and improve financial performance. These expectations are leading to significant changes to the treasury functions as activities are increasingly being centralized.

At the same time, most companies are experiencing more complexity with regard to changing compliance requirements, diverse global operations, regional and local regulatory mandates, international trade and foreign currency issues, geographically diverse banking relationships and escalating risk factors in the financial arena.

So, the key question that now arises is “what is the best approach for both today and for tomorrow?”

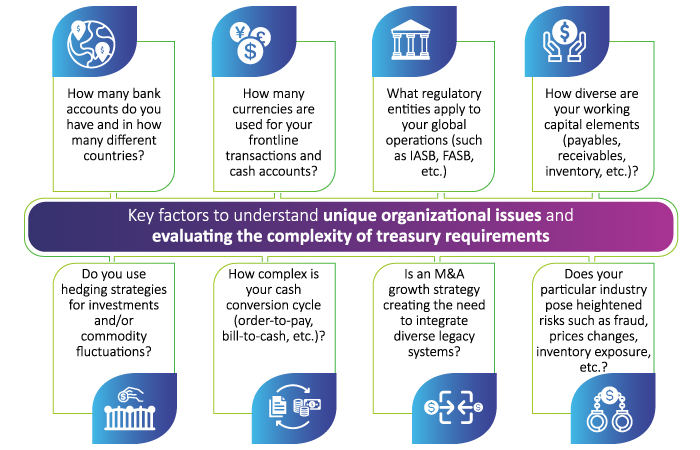

The answer really depends on understanding your unique organizational issues and evaluating the complexity of your treasury requirements. Some of the key factors to consider include:

- How many bank accounts do you have and in how many different countries?

- How many currencies are used for your front-line transactions and cash accounts?

- What regulatory entities apply to your global operations (such as IASB, FASB, etc.)

- How diverse are your working capital elements (payables, receivables, inventory, etc.)?

- Do you use hedging strategies for investments and/or commodity fluctuations?

- How complex is your cash conversion cycle (order-to-pay, bill-to-cash, etc.)?

- Is an M&A growth strategy creating the need to integrate diverse legacy systems?

- Does your particular industry pose heightened risks such as fraud, prices changes, inventory exposure, etc.?

For example, if you are a small to mid-sized company with relatively little international risk exposure, few bank accounts, a stable working capital profile, and only one centralized ERP/finance system, you can probably get by with a standalone solution – assuming the price is competitive with other options.

On the other hand, if you are concerned about three or more of the eight issues listed above, then you should definitely take a hard look at the hidden costs of a standalone approach versus the inherent benefits of a treasury management solution that is tightly integrated.

Key Benefits of Treasury Integration

- Minimize Interfaces between Systems:

By their nature, standalone treasury applications need to have a variety of communications interfaces defined and implemented in order to pull in the full spectrum of data needed to manage treasury functions. This is not only a significant upfront cost; is also represents an ongoing hidden cost of maintenance to tweak or update interfaces whenever needs change or other entities are added to your corporate ecosystem. - Streamline visibility and agility:

By integrating treasury directly into your overall ERP/finance system, users throughout the organization can benefit from using a single-source-of-truth for all of the data sources feeding into the centralized treasury functions. Instead of wasting time reformatting, accumulating, verifying and cleansing the data, users throughout the company can see and act on the same information for faster and more accurate decision-making. - Enhance productivity:

Treasury staff in the Office of the CFO can be much more productive and eliminate wasted time by seeing the complete picture of key issues, such as cash, bank accounts, working capital, risks, and liquidity, across the whole enterprise. Using integrated treasury applications that support a “drill-down and drill-through” approach, they are better able to carry out roll-up analysis for the whole company or to conduct detailed ad hoc analysis of specific issues when needed. - Maximize overall asset usage and improve business results:

Perhaps the most important benefit of an integrated treasury management system is the ability to better utilize cash and other assets to drive growth and profitability while minimizing risk and assuring regulatory compliance.

In summary, the use of integrated solutions, such as SAP’s Treasury and Risk Management applications, enable CFOs and their staff to seamlessly bring together core treasury functions and overall business operations in a comprehensive and highly efficient manner that optimizes results while enhancing agility and establishing a sustainable environment for growing and transforming the entire enterprise.

To serve the needs of client companies, SAP is massively investing in the integrated treasury suite and continuously adding new features. Learn more about the full breadth of SAP Treasury capabilities.

Also, click here to view Bramasol’s recent webinar video on SAP Treasury Solutions.