Previously in this blog series, we have discussed the impacts of the Digital Solutions Economy™ (DSE) on the software and SaaS sector. This new post provides a deeper dive into the key issues involved with optimizing end-to-end Order-to-Cash (OTC) and revenue recognition compliance for SaaS offerings.

With roots going back to the late 1990s, Software-as-a-Service is one of the most mature subscription-based models around. On one hand, the proven nature of SaaS has paved the way for widespread acceptance across both B2B and B2C markets. However, on the other hand, many older SaaS implementations evolved with disparate systems for handling the frontend customer-facing subscriptions separately from all the backend OTC and compliance processes.

As SAP's high-tech industry executive Patrick Maroney says, " Offering a usage- or subscription-based solution entails a fundamental change in your business model, which requires synchronization and native integration between commerce, configuration, engineering, pricing, quotation, finance, supply chain, billing/invoicing and entitlement management."

With the world now rapidly turning toward digital transformation using cloud-based solutions, we are entering a phase where SaaS systems in the cloud are being deployed to manage SaaS offerings in the cloud.

Keys to Success with Implementing OTC-to-Compliance in the Cloud

Although the overall goal is to create a seamless unified frontend and backend system in the cloud, depending on your specific situation and legacy investments, the implementation of OTC-to-Compliance may require different approaches.

Guiding concepts for successful implementation should consider the following:

- Maximize use of integrated systems with a single-source-of-truth

- Minimize separate databases, such as for subscriptions vs. contracts vs. revenues, etc.

- Tailor functionality to your specific needs and minimize complexity

- Align OTC and compliance functions within your overall enterprise-wide ERP system

- Plan ahead for scalability and flexibility to accommodate changes and optimize agility

As one of SAP's longest serving partners and the recognized experts in SAP revenue compliance and SAP BRIM/OTC offerings, the Bramasol team has deep experience with tailoring a range SAP solutions to specific client requirements.

For example, SAP's Order-to-Cash portfolio, formerly known as BRIM, offers a suite of applications, including Subscription Order Management, Subscription Billing, Convergent Charging, Convergent Mediation, and Convergent Invoicing, along with SAP Revenue Accounting & Reporting (RAR) for revenue compliance.

However, not all of these elements are required for every implementation. Or, in some cases, it can make sense to start small and add functionality according to a pre-determined plan.

Bramasol takes a unique approach to combining specific SAP BRIM applications with revenue compliance to give companies the exact features they need.

For example, the Bramasol team recently implemented targeted Subscription Billing functions with SAP RAR in the SAP S/4HANA Public Cloud for a real-world customer in less than three months. In such a case, where the key requirement is managing OTC-to-Compliance for recurring revenue without complex bundling or usage-based offerings, Public Cloud Subscription Billing can be an excellent out-of-the-box approach. For more detail on leveraging Subscription Billing with RAR, register for this upcoming January 31 webinar.

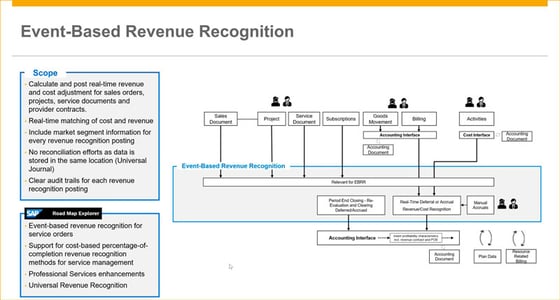

Another benefit of the SAP Public Cloud is the ability to leverage SAP Event Based Revenue Recognition (EBRR) functionality to integrate both revenue and cost information seamlessly. In this situation, one source document triggers the creation of two separate journal entries directly in the general ledger. This provides the basis for real-time matching of revenue and cost. It also includes market segment information for every revenue recognition posting, so there is no need for separate settlement of business objects. The revenue recognition process is fully integrated into the Universal Journal. This means that revenue recognition data is stored in the same location as cost and revenue data, so there is no need for juggling and combining separate data sources.

The SAP ecosystem with BRIM/OTC, RAR and S/4HANA also enables seamless interaction and end-to-end transparency between all players in the process, including customer, sales manager, product manager, billing operations manager and revenue manager. Watch the short video below to learn more.

Although it is a good practice to first focus on leveraging SAP Public Cloud functionality within a fit-to-standard approach, for those situations that require custom functionality in either Private Cloud or On-premise environments, it's important to work with experts such as Bramasol who have deep experience across both fit-to-standard and fit-to-gap approaches.

Summary

As the SaaS industry segment continues to expand and diversify, while digital transformation also gains more attention for companies of all sizes and types, it is critical that SaaS companies chart a forward path that provides near-term ROI as well as long-term efficiency, scalability and adaptability.

The holistic set of capabilities now available within the SAP Public Cloud offer an excellent starting point and comprehensive integration capabilities for bringing together the entire end-to-end Order-to-Cash-to-Compliance process within the unifying umbrella of S/4HANA. Depending specific company requirements, you may be able to address everything with an out-of-the-box Public Cloud approach. Or if you need expanded capabilities, the SAP S/4HANA ecosystem offers a solid foundation for implementing additional functionality