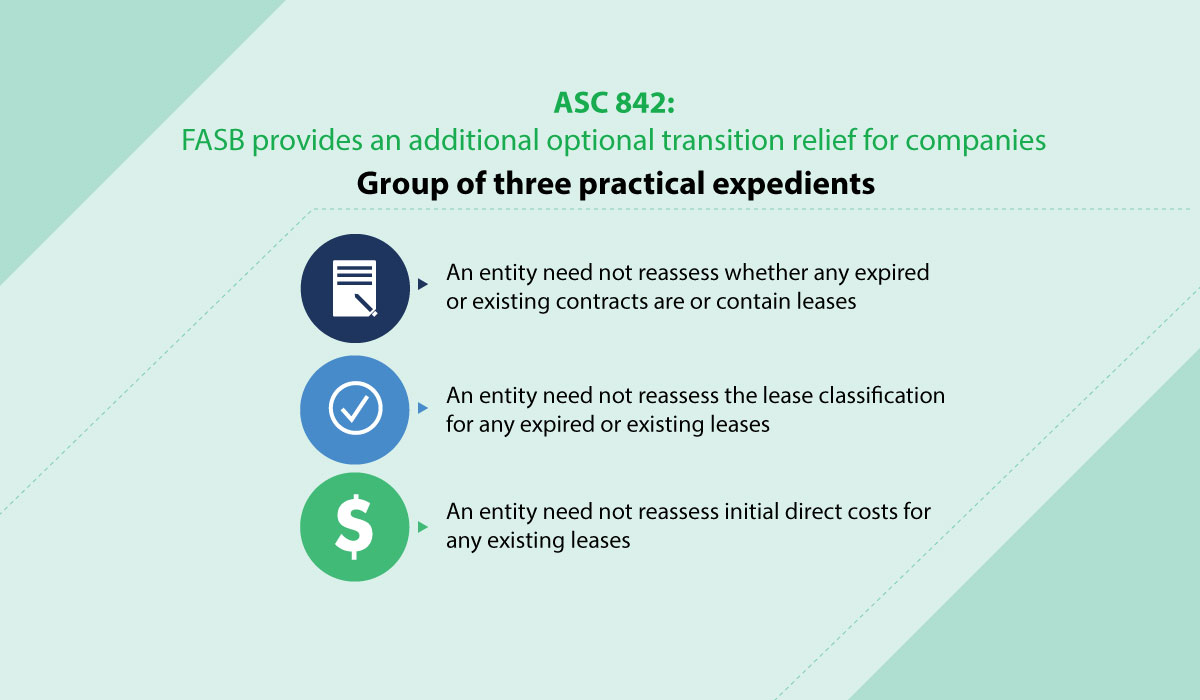

On January 5th, 2018, the Financial Accounting Standards Board (FASB) proposed adding an optional transition method and another practical expedient for lessors to Accounting Standards Codification (ASC) 842, Leases, to reduce the cost and complexity of implementing the new standard.

ASC 842: FASB provides an additional optional transition relief for companies