Corporate finance professionals face many challenges. They need to reduce the amount of time spent on inefficient month-end/year-end closing processes, improve their ability to extract timely and accurate financial information and streamline overall operational end-to-end business processes.

Corporate finance professionals face many challenges. They need to reduce the amount of time spent on inefficient month-end/year-end closing processes, improve their ability to extract timely and accurate financial information and streamline overall operational end-to-end business processes.

On the regulatory front, CFOs also must deal with, Revenue Recognition Changes (ASC 606 and IFRS 15), Lease Accounting Changes (ASC 842 & IFRS 16), Financial Instruments Impairments & Disclosures (IFRS 9) as well as on-going changes in the global regulatory environment.

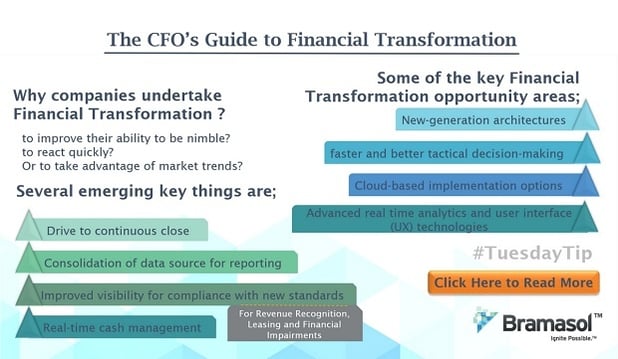

The accelerating set of new challenges and changing compliance requirements threatens to overwhelm the inherent limitations of existing legacy finance and ERP systems. As companies undertake Financial Transformation to improve their ability to be nimble, react quickly and take advantage of market trends, several key things are emerging:

- Drive to continuous close

- Consolidation of data sources for reporting

- Improved visibility for compliance with new standards for Revenue Recognition, Leasing and Financial Impairments

- Real-time cash management

Some of the key Financial Transformation opportunity areas include:

- New-generation architectures, such as SAP S/4HANA, that combine core ERP & Finance systems with plug-in modular best-of-breed capabilities for revenue recognition, leasing, ecommerce, HR, travel, supply chain management, and more.

- A “single-source-of-truth” approach that avoids discussions of who’s data is right, thereby enabling much faster and better tactical decision-making.

- Cloud-based implementation options that can greatly reduce time-to-operation and which integrate seamlessly with in-house implementations to enable cost optimization along with flexibility and scalability to support growth.

- Advanced real time analytics and user interface (UX) technologies that can access information throughout the unified systems and provide easily tailored comprehensive reporting for ongoing management or ad hoc decisions.

Corporate finance professionals depend on the technologies and tools that provide critical information they need to drive timely decisions and to anticipate emerging issues that could impact the business.

By leveraging the in-memory data and processing capabilities of the SAP S/4HANA architecture and S/4HANA Cloud deployment scenarios, CFOs can seamlessly unify their information landscape to remove the gaps and ease the pain-points arising from the artificial segmentation of information.

Instead of always grappling with reassembling disparate pieces of the picture this "single-source-of-truth" approach enables CFOs and staff throughout the company to see a holistic real-time view that encompasses all operational data sets and analysis capabilities within a single unified architecture. In addition to improving both the access to and the ability to manipulate information, S/4HANA also dramatically improves real-time analytics performance because nothing must be moved, massaged or reconciled before the analysis.

To learn more, read the CFO's Guide to Financial Transformation