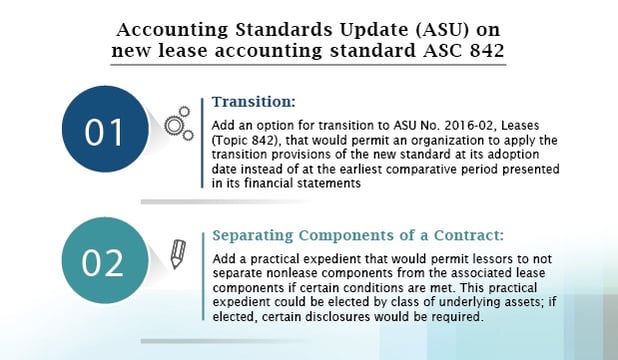

On January 5, 2018, the Financial Accounting Standards Board (FASB) issued a proposed Accounting Standards Update (ASU) regarding the new lease accounting standard ASC 842.

On January 5, 2018, the Financial Accounting Standards Board (FASB) issued a proposed Accounting Standards Update (ASU) regarding the new lease accounting standard ASC 842.

The proposed ASU is intended to reduce costs and ease implementation of the Leases standard for financial statement preparers. Stakeholders are encouraged to review and provide comment on the proposed improvements by February 5, 2018.

Two key proposed changes in this ASU deal with comparative reporting during the transition period and a practical expedient for simplifying the requirements to separate nonlease components of a contract. Summaries of the proposed changes are below.

Transition:

"Comparative Reporting at Adoption The amendments in this proposed Update would provide entities with an additional (and optional) transition method to adopt the new lease requirements by allowing entities to initially apply the requirements by recognizing a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption consistent with the request by preparers. Consequently, an entity’s reporting for the comparative periods presented in the financial statements in which the entity adopts the new lease requirements would continue to be in accordance with current GAAP (Topic 840), including disclosures."

Separating Components of a Contract:

"The amendments in this proposed Update would provide lessors with a practical expedient, by class of underlying assets, to not separate nonlease components from the related lease components and, instead, to account for those components as a single lease component, if both of the following are met: 1. The timing and pattern of revenue recognition for the nonlease component(s) and related lease component are the same. 2. The combined single lease component would be classified as an operating lease. A lessor electing this proposed practical expedient would be required to disclose the class or classes of underlying assets for which it has elected the practical expedient and the nature of the nonlease components included within the single lease component."