Today’s CFO is bombarded with buzzwords and talk about the latest and greatest trends in corporate finance. The typical finance professional is usually occupied with more practical considerations. Buzzwords aren’t high on the agenda when some new regulatory control is fighting for your attention or you’re busy keeping an eye on the bottom line.

Still, those buzzwords and trends persist. It’s little wonder that finance pros are confused by it all.

Here are a few such terms you might have heard of:

- Predictive accounting – using accounting to predict revenue.

- Machine learning in finance and accounting.

- Robotic Process Automation (RPA).

It’s natural to ask whether any of this matters. Is it worth devoting mental bandwidth to these new trends?

This post is a summary of why I think these trends may be relevant to you, and how getting onboard now can help you add long-term value to your organization.

Current trends for the modern finance professional

This summary covers some of the latest trends in finance and accounting.

Predictive accounting

This is about projecting or predicting metrics for tomorrow based on what you know today. There’s nothing groundbreaking in the idea of projections, but the way it can be done in accounting is interesting.

Instead of a top-down view based on longstanding mathematical models, there can be a modern bottom-up approach that says, ‘Look forward based on current orders and predict what revenue is coming in the next quarter.’

This predictive accounting is automated and based on algorithms that provide revenue projections.

Machine learning

Humans learn by experience. Modern software also has the potential to learn by experience, and that experience comes from good data.

With data acting as the reference points of experience, machines can say, 'Based on what I've seen in the past, these are the rules that I’m going to apply in future.'

A machine’s learning process involves creating some exceptions. Over time, those exceptions reduce as machine learning improves and crunches through more data.

All that means that many of the tasks we were doing manually can now be automated. Putting in good data and training the software frees us up to do more creative analysis.

Robotic Process Automation (RPA)

RPA is the equivalent of showing someone how an app or process works.

Instead of writing a complicated script, you can use RPA to watch you perform actions in your systems – and then it can repeat those actions while you carry out other tasks.

RPA doesn’t stop at blind copying. It allows more nuanced workflows such as ‘move this invoicing data from X to Y – and then do the next step I showed you.’

The opportunities here are huge. With good data and good processes to start with, you’ll can take advantage of RPA to hand off the boring, repetitive tasks and focus instead on analysis and other more stimulating activities.

Why should we care?

Standing still isn’t a smart move. Today’s startups are keeping the bigger players on their toes. We have to keep our head in the game and do the things that move our businesses forward.

The big reason for caring about modern trends is: we don’t have time to waste on boring manual tasks.

Automation matters – and applying it wisely gives us more space to focus on creative analysis.

Automation matters – and applying it wisely gives us more space to focus on creative analysis.

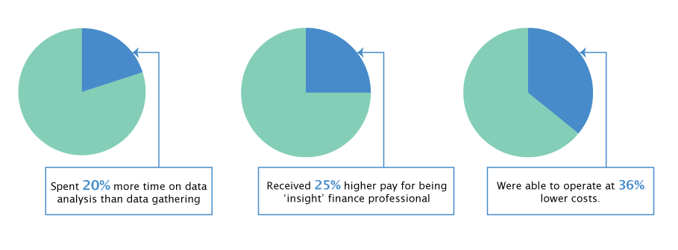

A 2017 report by PwC showed the value of automation, reporting that top performers in financial services:

- Spent 20% more time on data analysis than data gathering.

- Received 25% higher pay for being ‘insight’ finance professionals.

- Were able to operate at 36% lower costs.

Source: Finance Effectiveness Benchmark Report 2017

According to a 2018 study by The Hackett Group:

- 97% of finance professionals believe digital transformation will fundamentally affect the way finance services are delivered.

- 96% believe it will offer a step change in performance.

From that same study, only 35% think their organizations are ready for digital transformation.

Source: Building a Value-Driven Business Case for Finance Digital Transformation

Focusing on what matters

Pushing boring rote activity to an automated system means you can focus on analysis – the work that still requires human insight and where you can stand out from other CFOs.

A few years back, I was on a project to improve business processes, which involved upgrading systems with a new version of SAP. During an executive steering meeting, there was a 16-inch high stack of checks for executives to sign. Because some of the checks went beyond the limits of what those executives could sign, there was a time-consuming manual process to get the task cleared.

Clearly, this was a perfect case to automate the process and let the machines take the strain. That did indeed happen, cutting the 16-inch stack of checks down to about 1.5 inches – a visible testament to the power of automation.

But there’s an important caveat.

Automating a bad process will just get you bad results faster

For automation to work well, we need two essential components:

- Good processes.

- Good data.

Prepping for automation is a good way to inspect your processes and improve them to the point where it’s worth automating them.

Bad processes and bad data will lead to an obvious result: garbage in, garbage out. In other words, bad inputs produce bad conclusions.

To bring this back to the real world and compliance with IFRS regulations, you need to have a good understanding of matters such as the timing of revenue. That leads to questions you should ask yourself:

- What is the nature of my revenue types?

- Do I have multi-element arrangements?

- Where are my leases?

- How do I see my interest rates?

You need a thorough understanding to answer these questions – and automation is essential to doing this.

Reliable data and detailed documenting of your processes mean you can get automation to lift some of your burden.

Get the building blocks right

Getting ready for automation is a great way to put your house in order. It means you naturally do the things that give you a better chance to achieve compliance with a range of IFRS regulations.

We have to remember that the regulations aren’t there to be holes in the road, looking to blow out our tires at the first chance. They’re the road signs that show us good practice, which matters to our customers.

Getting data quality, insights and integration right means we get meaningful results. It’s just the same as laying the right road and following the signs to reach the intended destination.

At Bramasol, we’re the experts in finance compliance. That means our customers are trusting us to advise them on how best to build that road.

CFOs are starting to see that the right tools can help them to achieve finance compliance by fixing and handing off rote processes so that automation does the work.

With quality data, quality processes and repeatable/auditable steps, today’s finance pros can get machines to do the heavy lifting, leaving them more time to focus on the activities that make a real impact.

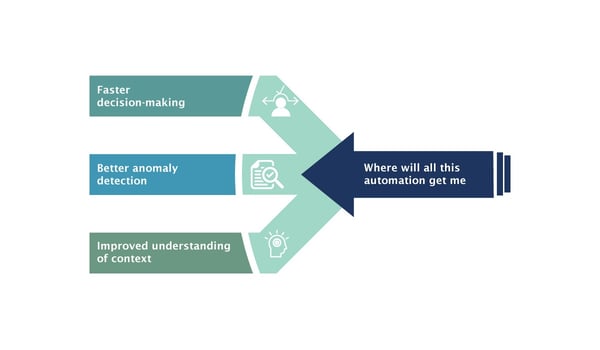

Where will all this automation get me?

Setting yourself up for automation conditions you to scrutinize your processes and fix the flaws. Not only does that mean better processes but also it leads to better compliance.

Setting yourself up for automation conditions you to scrutinize your processes and fix the flaws. Not only does that mean better processes but also it leads to better compliance.

There are a host of benefits versus the old manual way of doing things:

- Faster decision-making.

- Better anomaly detection.

- Improved understanding of context (drill down and then through to transactional data).

The bottom line is that all this means saving time, money and resources. Think about savings on cost avoidance or through competitive advantage because you're able to act quickly.

It’s time to change

Those new trends, those dashboards, those analytics – they are the shape of finance transformation.

Now is a good time to get your processes in order and embrace compliance. You’ll see how it can benefit you, because your data will be better.

And good data and good processes mean you’re set up to automate more of the boring tasks so you can focus on the exciting work – and that’s what’s going to give you a competitive advantage and keep your customers happy well into the future.