FASB Issues Accounting Standards Update 2016-08

FASB Issues Accounting Standards Update 2016-08

Revenue from Contracts with Customers

Principal versus Agent Considerations

An issue discussed by the Transition Resource Group (TRG) for Revenue Recognition relates to when another party, along with the entity, is involved in providing a good or a service to a customer.

In those circumstances, Topic 606 requires the entity to determine whether the nature of its promise is to provide that good or service to the customer (that is, the entity is a principal) or to arrange for the good or service to be provided to the customer by the other party (that is, the entity is an agent).

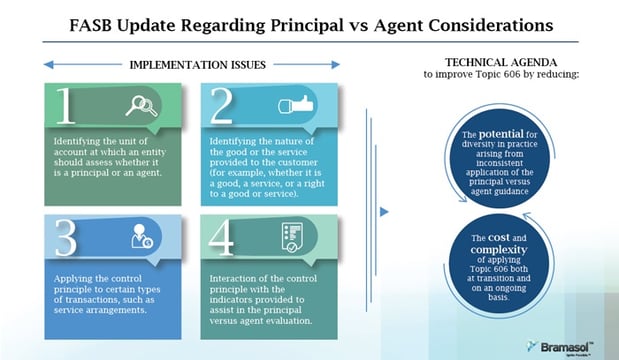

This determination is based upon whether the entity controls the good or the service before it is transferred to the customer. Topic 606 includes indicators to assist in this evaluation. Discussions at TRG meetings informed the Board about implementation issues related to the guidance on principal versus agent considerations, including:

- Identifying the unit of account at which an entity should assess whether it is a principal or an agent

- Identifying the nature of the good or the service provided to the customer (for example, whether it is a good, a service, or a right to a good or service)

- Applying the control principle to certain types of transactions, such as service arrangements 4. Interaction of the control principle with the indicators provided to assist in the principal versus agent evaluation.

To address those issues, the Board decided to add a project to its technical agenda to improve Topic 606 by reducing:

- The potential for diversity in practice arising from inconsistent application of the principal versus agent guidance

- The cost and complexity of applying Topic 606 both at transition and on an ongoing basis.

Who Is Affected by the Amendments in This Update? The amendments in this Update affect entities with transactions included within the scope of Topic 606. The scope of that Topic includes entities that enter into contracts with customers to transfer goods or services (that are an output of the entity’s ordinary activities) in exchange for consideration.

For more information, read the FASB Update here.