There is less than two months before the mandated adoption of new Revenue Recognition standards ASC 606 and IFRS 15. Since companies need to comply with legal disclosure reporting requirements, including a retrospective dual-reporting period between current ASC 605 and new ASC 606, it is critical that you have a clear disclosure reporting plan in place, NOW!

There is less than two months before the mandated adoption of new Revenue Recognition standards ASC 606 and IFRS 15. Since companies need to comply with legal disclosure reporting requirements, including a retrospective dual-reporting period between current ASC 605 and new ASC 606, it is critical that you have a clear disclosure reporting plan in place, NOW!

Using SAP Revenue Accounting and Reporting (RAR) as the engine to track sales contracts and revenue recognition enables implementation of ASC 606 requirements within SAP ERP/ECC, S/4HANA Cloud or 3rd Party ERP environments. RAR also facilitates the ability to create highly-flexible analytics to provide companies with the specific quantitative information needed to fulfill statutory reporting requirements.

As the leading co-innovator with SAP on the development of SAP RAR, Bramasol has more SAP RAR implementation projects and active live SAP RAR sites than anyone in the industry. Bramasol has created a rich set of management and visualization tools to enhance the modeling, pilot, implementation and transition processes. SAP RAR can go-deep on any aspect of revenue recognition and the Bramasol enhancements are designed to visually surface any set of relevant information needed to support accurate understanding and timely decision making.

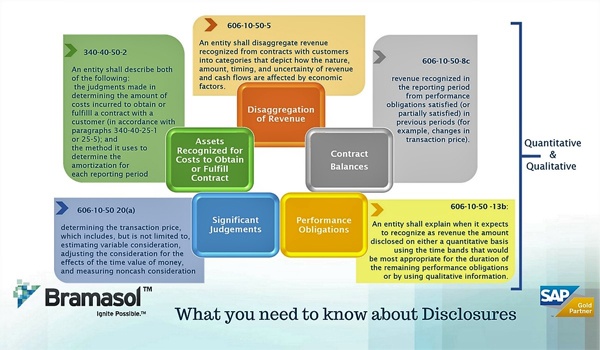

With Disclosure Reporting now on the near horizon, Bramasol has once again taken proactive steps to help companies stay ahead of the curve by developing a collection of specific reports for public entities to meet ASC 606-10-50x disclosure reporting requirements.

Bramasol’s end-to-end integrated solutions for revenue recognition compliance fit seamlessly within any existing operational and financial systems while providing the detailed information, audit trail, aggregation methodologies and advanced analytics to support statutory disclosure reporting.

Click Here to Download eBook on RevRec Disclosure Reporting.