Account Determination is a critical step in transitioning to the new ASC606 and IFRS15 revenue recognition rules using SAP Revenue Accounting and Reporting (RAR).

Account Determination is a critical step in transitioning to the new ASC606 and IFRS15 revenue recognition rules using SAP Revenue Accounting and Reporting (RAR).

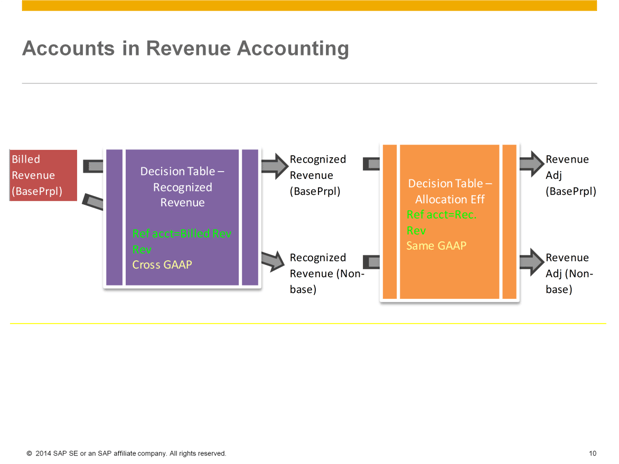

In SAP RAR 1.2, certain account determination rules derive the target account for the target accounting principle from a reference account that exists under a specific accounting principle, known as the "base accounting principle".

The reference accounts passed from the logistics system are only for the base accounting principle. Therefore, you can use a different set of rules to determine the reference accounts for accounting principles other than the base accounting principle. These reference accounts are used to make postings for recognizing revenue. They are also used as an input to the other account determination rules (allocation difference, allocation difference for linked performance obligations, and right-of-return adjustment).

For each revenue-related posting, the system provides a reference account as the starting point of the account determination process. The reference account is provided as the input of your determination rules. This account usually comes from outside Revenue Accounting and varies depending on the type of account that needs to be determined. For example, when determining the account of the Receivable Adjustment account, the system uses the Accounts Receivable account (defined in the master data of the customer record) as the reference account, so your determination rules can use that account to derive the account that will eventually be used. Your rules can disregard the reference account and use other fields as the criteria.

To learn more about the details of Account Determination and the implementation of SAP RAR 1.2 you can request a free consultation.