Now that the January 2018 deadline has passed, and public companies must now adopt the new revenue recognition standard, ASC 606, disclosures become the central focus of the implementation process.

Now that the January 2018 deadline has passed, and public companies must now adopt the new revenue recognition standard, ASC 606, disclosures become the central focus of the implementation process.

This assumes that companies have already diagnosed, scoped and concluded how they will implement the new standard - and also assumes your external auditors have already signed off on your implementation project!

Now you must consider what readers of your financial statements will see when they read your Q1 2018 financial statements. Q1 2018 is the first reporting period that companies will disclose the new revenue recognition footnote and all the related new informational data points that it includes.

The objective of the standard is to disclose sufficient information to enable users of financial statements to understand the nature, amount, timing, and uncertainty of revenue and cash flows. Entities can accomplish this by providing qualitative and quantitative information regarding its contracts with customers, the estimates and judgments used to measure its revenue, and the nature of any assets recognized related to the costs of obtaining the contracts.

Although ASC 606 is a principle-based standard, it does provide many requirements. The following briefly describes the requirements within the broad disclosure topics:

- Disaggregation of revenue

- Contract balances

- Performance obligations

- Transaction price allocated to remaining performance obligations

- Significant judgments in the application of the guidance

In this blog, we touch on a new requirement within the performance obligations reporting:

Transaction Price allocated to the Remaining Performance Obligations.

ASC 842 states the following:

“An entity shall disclose all of the following information about its remaining performance obligations:

- The aggregate amount of the transaction price allocated to the performance obligations that are unsatisfied (or partially unsatisfied) as of the end of the reporting period

- An explanation of when the entity expects to recognize as revenue the amount disclosed in accordance with paragraph 606-10-50-13(a), which the entity shall disclose in either of the following ways:

- On a quantitative basis using the time bands that would be most appropriate for the duration of the remaining performance obligations

- By using qualitative information. “

So, what does this mean? Companies in the construction and project-based industries where they currently use percentage of completion accounting will be familiar with this because it is similar to backlog.

There are three main differences though that you need to consider upon ASC 606 implementation:

- Previously, backlog was never audited and was never part of the footnotes to the financial statements. Now they will be and that means that it will receive more scrutiny from your external auditors.

- There is no official definition or a standard way to calculate backlog. Some companies’ inbound orders based on signed deals, others inbound based on likelihood or verbal contracts. As you can see there is no official definition of backlog.

- Companies who are not accustomed to preparing a backlog type analysis will now be required to prepare such analyses.

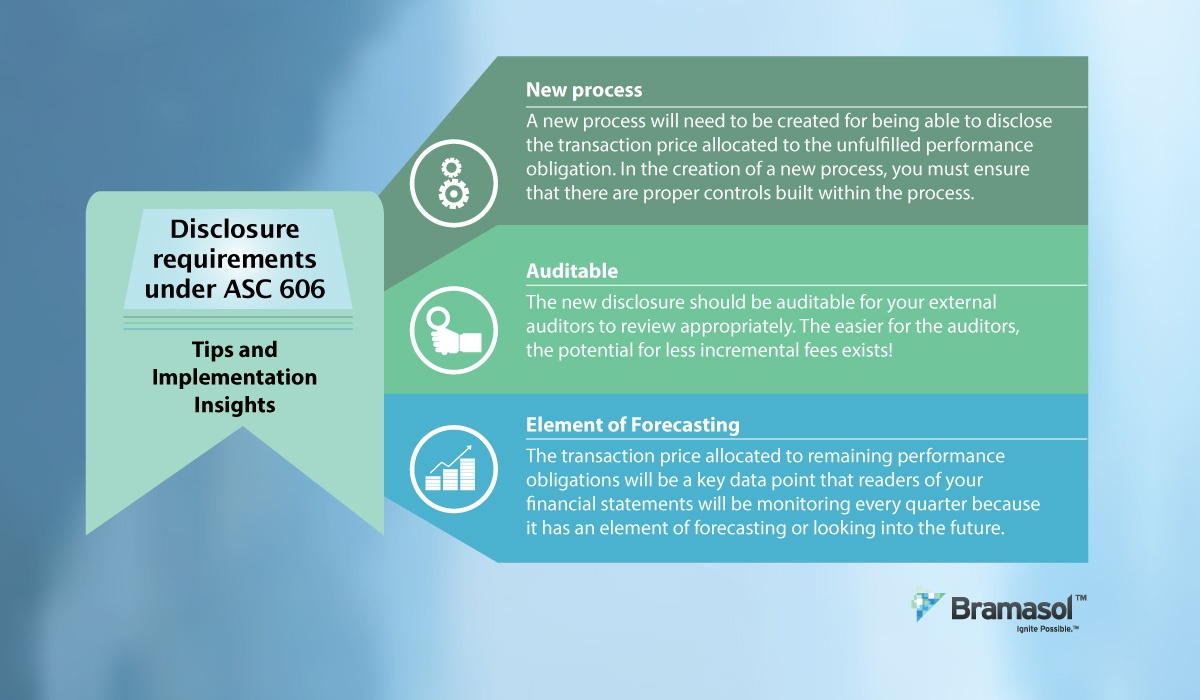

Tips and Implementation Insights:

- New process: A new process will need to be created for being able to disclose the transaction price allocated to the unfulfilled performance obligation. In the creation of a new process, you must ensure that there are proper controls built within the process. Questions such as, “Who is going to prepare the data in the report? Who is going to approve the data in the report? Is it going to be a system control or a manual control?

- Auditable: The new disclosure should be auditable for your external auditors to review appropriately. The easier for the auditors, the potential for less incremental fees exists!

- Element of Forecasting: The transaction price allocated to remaining performance obligations will be a key data point that readers of your financial statements will be monitoring every quarter because it has an element of forecasting or looking into the future. Readers of your financials will likely cross reference this to your guidance (if in fact your company does give guidance) so there is a real need to make sure that FPA, Accounting and Reporting are all in sync. More likely than not, FPA would probably use the new disclosure point as a starting point for the forecast process.

If you need assistance understanding, implementing and/or optimizing these and other requirements of the new RevRec standards, Contact Bramasol for s RevRec Demo.