As the January 2019 deadline for implementing new lease accounting standards (ASC 842 and IFRS 16) approaches, FASB has been addressing a number of issues that arise with regard to transitioning from current regulatory practices to the new standards.

As the January 2019 deadline for implementing new lease accounting standards (ASC 842 and IFRS 16) approaches, FASB has been addressing a number of issues that arise with regard to transitioning from current regulatory practices to the new standards.

As part of this evolutionary process, FASB has issued Accounting Standards Update 2018-01 "Land Easement Practical Expedient for Transition to Topic 842".

This update will be of particular importance for industries such as Oil & Gas, Telecommunications, Utilities and other sectors that traditionally depend heavily on easements and rights of way to conduct their business.

In connection with the FASB’s transition support efforts, a number of stakeholders in these industries have inquired about the application of the new lease requirements in Topic 842 to land easements. Land easements (also commonly referred to as rights of way) represent the right to use, access, or cross another entity’s land for a specified purpose.

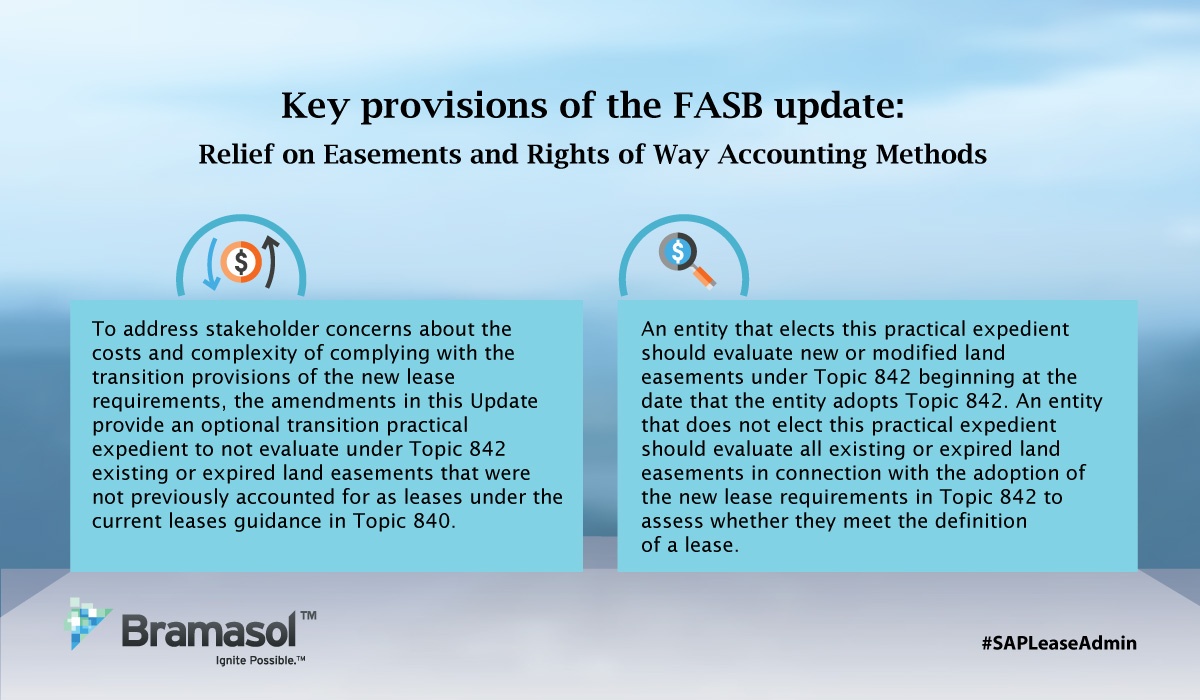

Key provisions of the update are as follows:

"To address stakeholder concerns about the costs and complexity of complying with the transition provisions of the new lease requirements, the amendments in this Update provide an optional transition practical expedient to not evaluate under Topic 842 existing or expired land easements that were not previously accounted for as leases under the current leases guidance in Topic 840.

An entity that elects this practical expedient should evaluate new or modified land easements under Topic 842 beginning at the date that the entity adopts Topic 842. An entity that does not elect this practical expedient should evaluate all existing or expired land easements in connection with the adoption of the new lease requirements in Topic 842 to assess whether they meet the definition of a lease."

Click Here to Read the Entire Update 2018-01 to Topic 842

Click Here for More Information on Bramasol Lease Accounting Solutions