There is less than six months before the mandated adoption of new Revenue Recognition standards ASC 606 and IFRS 15.

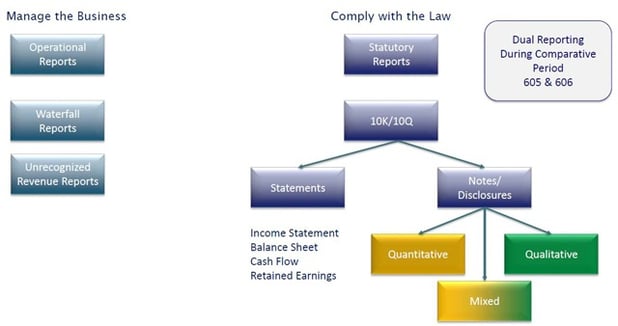

Since companies need to comply with legal disclosure reporting requirements, including a retrospective dual-reporting period between current ASC 605 and new ASC 606, it is critical that you have a clear disclosure reporting plan in place, NOW!

According to an SEC official at a recent Bloomberg BNA conference, "a number of companies have enhanced their transition disclosures. However, some companies indicate that the impact of the new revenue standard is not expected to be material. The changes in the new revenue standard will impact nearly all companies. Even if the extent of change on the balance sheet or income statement is not deemed to be material, the related disclosures may be material."

Compliance with the law is Not Optional.

Even before the January 2018 go-live date for the new standards, companies will need to start disclosing information regarding the impending changes as part of their regular 10Q and 10K financial reports.

This new eBook provides an overview of how the new standards will impact both business operations and financial reporting. Subsequent sections offer a deeper look at how companies can comply with the new revenue accounting standards while efficiently using the Operational Report data to inform and drive their Statutory Reporting requirements, such as Income Statement, Balance Sheet, Cash Flow, etc.

Please complete the info below to read the eBook: