RevRec Disclosure Reporting:

If You Haven't Started Yet,

You Are Late Already!

There is now only a little over six months before the mandated adoption of new Revenue Recognition standards ASC 606 and IFRS 15.

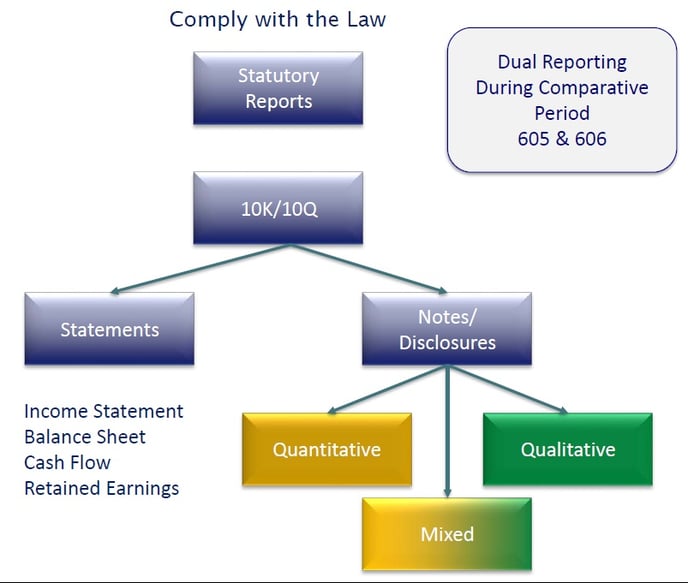

Since companies need to comply with legal disclosure reporting requirements, including a retrospective dual-reporting period between current ASC 605 and new ASC 606, it is critical that you have a clear disclosure reporting plan in place, NOW!

According to an SEC offical at a recent Bloomberg BNA conference, "a number of companies have enhanced their transition disclosures. However, some companies indicate that the impact of the new revenue standard is not expected to be material. The changes in the new revenue standard will impact nearly all companies. Even if the extent of change on the balance sheet or income statement is not deemed to be material, the related disclosures may be material."

Compliance with the law is Not Optional.

Even before the January 2018 go-live date for the new standards, companies need to be disclosing information regarding the impending changes as part of their regular 10Q and 10K financial reports.

In addition to leading the industry in implementing SAP Revenue Accounting and Reporting (RAR), Bramasol also has proactively developed new disclosure reporting mechanisms to encompass and report on both ASC 605 legacy data and new ASC 606 compliance reporting.

There are three key actions that you can take right now to help get started on disclosure reporting:

- Register for June 28 webinar on Dual Reporting

- Pre-Request our next eBook on Disclosure Reporting (to be published this month)

- Request a Revenue Recognition Consultation

The clock is ticking faster now.

Will you be #RevRecReady ?