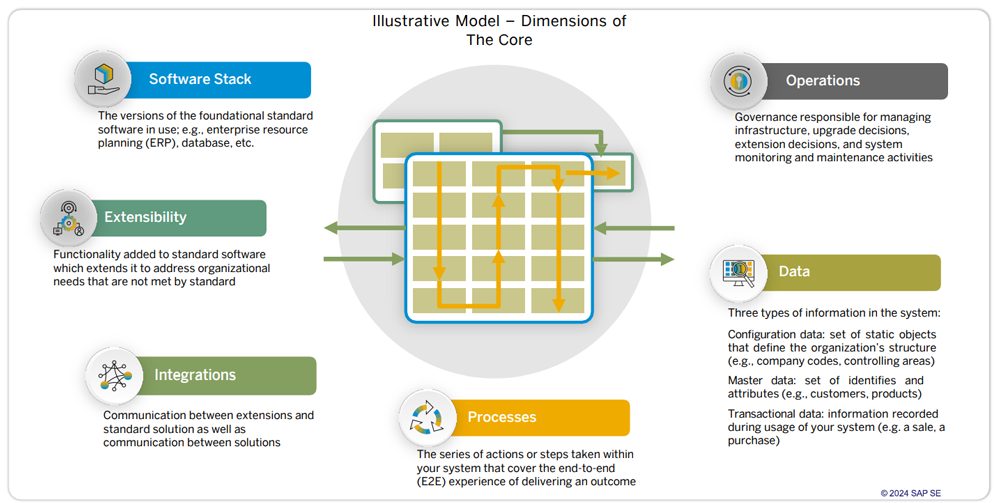

Recent posts in this series have provided updates on SAP RISE and GROW, with a focus on how they can help streamline the path for companies migrating to SAP public and private cloud editions. This new episode drills down into the concept of maintaining a "clean core" in your ERP system to assure a solid foundation that minimizes unnecessary customization, which could impede organizational agility going forward.

How SAP ERP Clean Core Helps Minimize Digital Debt and Enhance Agility

Thu, Mar 7, 2024 @ 03:18 PM / by David Fellers posted in s4/hana cloud, CEO perspective, Thought Leadership, RISE with SAP, clean core

Webinar- Update on the Latest Features in SAP Revenue Accounting and Reporting (RAR) to Help Optimize RevRec in 2023

Sun, Nov 6, 2022 @ 10:29 PM / by John Froelich posted in SAP Revenue Accounting and Reporting, s4/hana cloud, Financial Innovation, Automated Revenue Management

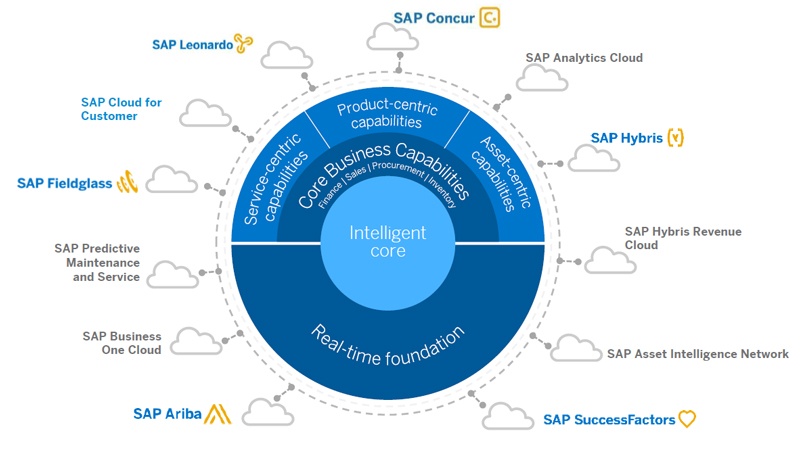

SAP Revenue Accounting and Reporting (RAR) provides market leading capabilities within the overall Automated Revenue Management portfolio of solutions, which are available in the SAP S/4HANA enabled Intelligent Enterprise.

Webinar- Cloud Based Revenue Accounting with Automated Revenue Management Solutions from SAP

Fri, Sep 10, 2021 @ 02:23 AM / by John Froelich posted in SAP Revenue Accounting and Reporting, s4/hana cloud, Financial Innovation, Automated Revenue Management

Everyone is moving to the cloud and so is RevRec! Cloud based Automated Revenue Management can help you comply, optimize and transform your revenue accounting across a full spectrum of application scenarios, especially recurring revenue models.

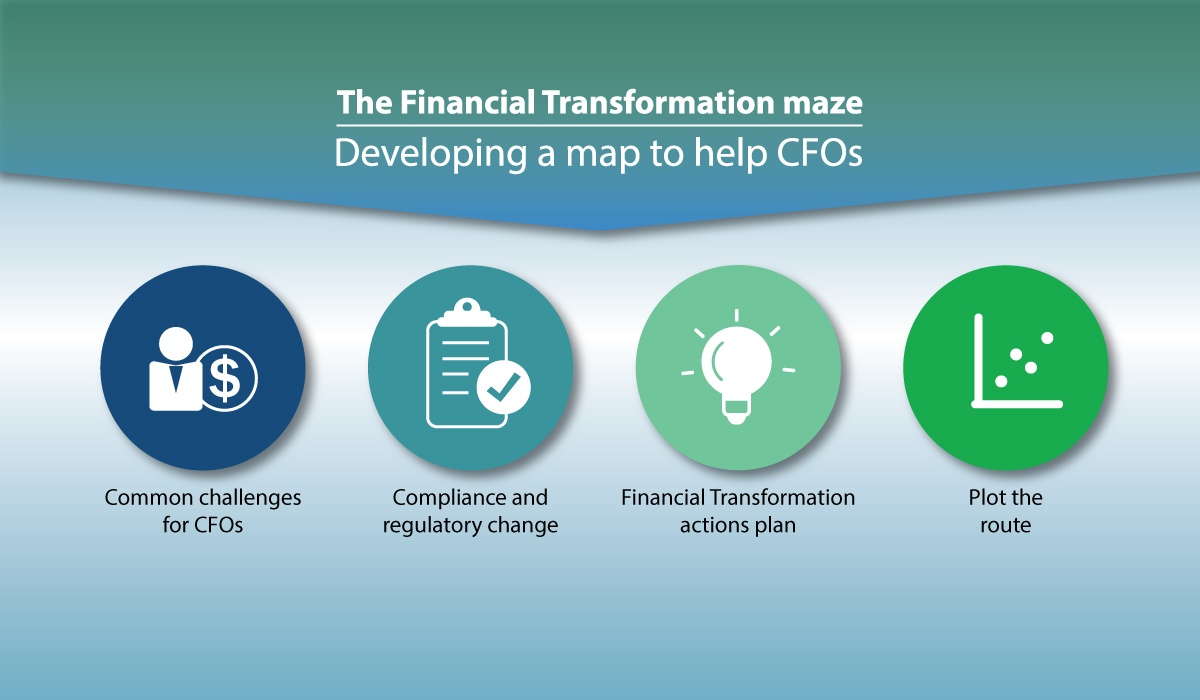

The Financial Transformation Maze – Developing A Roadmap To Help CFOs

Tue, Sep 18, 2018 @ 09:11 AM / by Trevor Lovegrove posted in CFO, financial transformation, s4/hana cloud, Financial Innovation, S4HANA, Thought Leadership

By 2020, corporate finance professionals are going to have some pretty big challenges on their hands. Compliance requirements are changing, and the inherent limitations of existing legacy finance and ERP systems are going to be at threat.

Data Drives Everything: Do you know where your data is and how to use it?

Wed, May 16, 2018 @ 04:33 AM / by David Fellers posted in data integration, s4/hana cloud, Thought Leadership

For the past forty years, companies have been building all their financial and business decisions around information contained in traditional data structures. Virtually all financial systems, no matter who has designed them, have been built around relational databases. This brings the same set of issues and challenges to every single system.