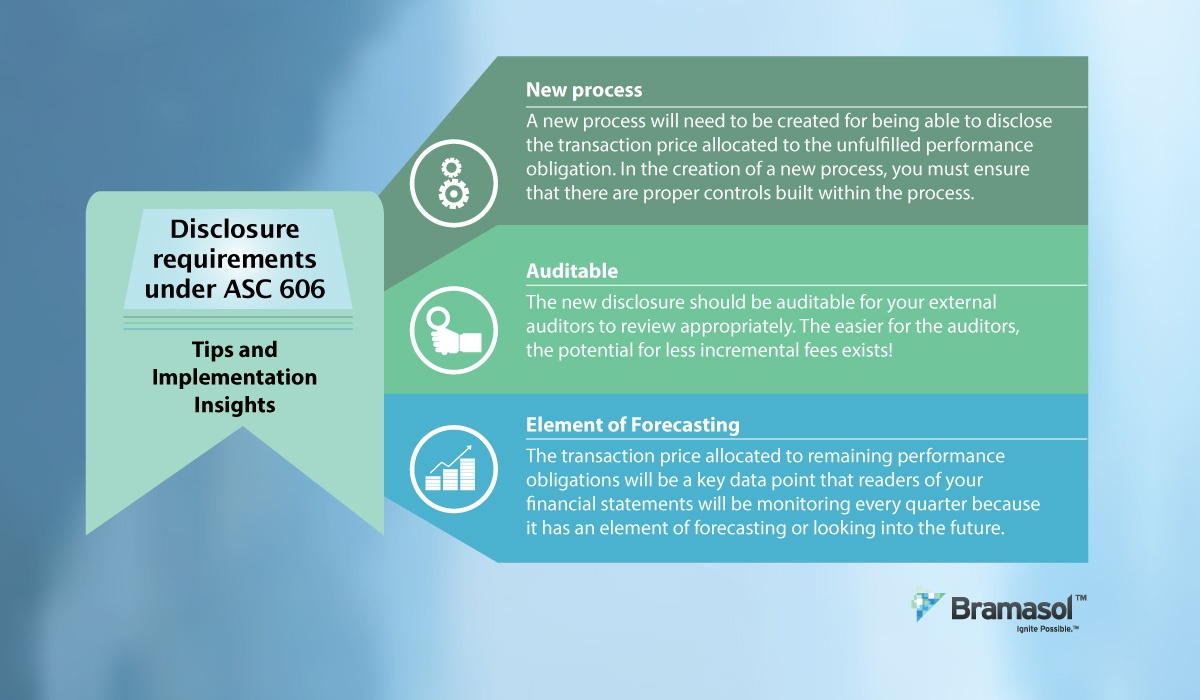

A recent article in Compliance Week paints a different picture from people who think that adoption of Revenue Recognition per ASC 606 is behind us. Even though the new standard took effect on January 1, 2018, the issue of compliance as seen by auditors and the SEC is now just ramping up.

Public companies on

Some highlights from the article include: