With the upcoming already extended deadline for the adoption of ASC 842, the new lease accounting standard in the US, many companies who have already adopted are struggling with managing the accounting under the new standard in spreadsheets or because they already chose a standalone software but are not happy with the results due to a lack of integration, causing reconciling issues or reporting inaccuracies.

Webinar - Streamline Your Lease Accounting Processes with Accelerators for Switching to SAP CLM

Wed, Aug 11, 2021 @ 04:26 AM / by John Froelich posted in webinar, leasing, ASC842, Leasing Solution, CLM, SAPCLM, Contract and Lease Management

Podcast- Improving Cash Flow and EBITDA with Active Lease Management

Mon, May 18, 2020 @ 09:32 PM / by David Fellers posted in SAP, ASC842, SAPLeaseAdmin, IFRS16, Leasing Solution, podcasts, SAPCLM

Listen to our latest Podcast on Improving Cash Flow and EBITDA with Active Lease Management. During this podcast, John Froelich, Bramasol VP of Marketing and Strategy, discusses Active Lease Management and explains how it can improve visibility of lease portfolios and cash flow along with enhancing financial performance.

Webinar Video - Technical Accounting Tips for Optimizing Disclosures and Reporting for ASC 606 and 842

Mon, Sep 9, 2019 @ 06:32 AM / by Bramasol Compliance Team posted in leasing, revrec, ASC606, ASC842, Compliance

According to the Big 4, over 50% of companies experienced a delay in compliance with ASC 606 and 842 due to accounting issues. Those same companies struggled to produce their disclosures and reporting. Underlying this are the technical accounting expertise and disciplines needed for success.

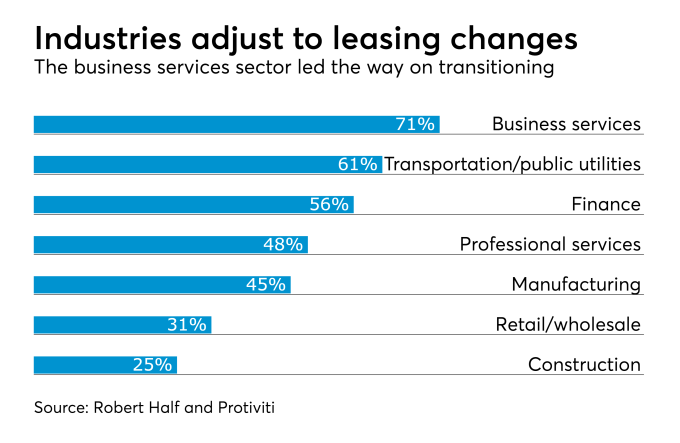

Companies Need Holistic Approach to Lease Accounting Compliance

Tue, Jun 5, 2018 @ 03:36 AM / by Bramasol Leasing Administration Team posted in Leasing-Hot-Tips, ASC842, IFRS16

A recent article in Accounting Today provides an excellent view of how companies in many industries are moving toward compliance with the new lease accounting standards, ASC 842 and IFRS 16.

General Availability for New Version 4.0 of SAP Lease Administration by Nakisa

Tue, May 29, 2018 @ 07:29 AM / by Bramasol Leasing Administration Team posted in Leasing-Hot-Tips, ASC842, SAPLeaseAdmin, IFRS16

Nakisa, Bramasol's partner for leasing solutions, has announced general availability of the new 4.0 version of Lease Administration by Nakisa.

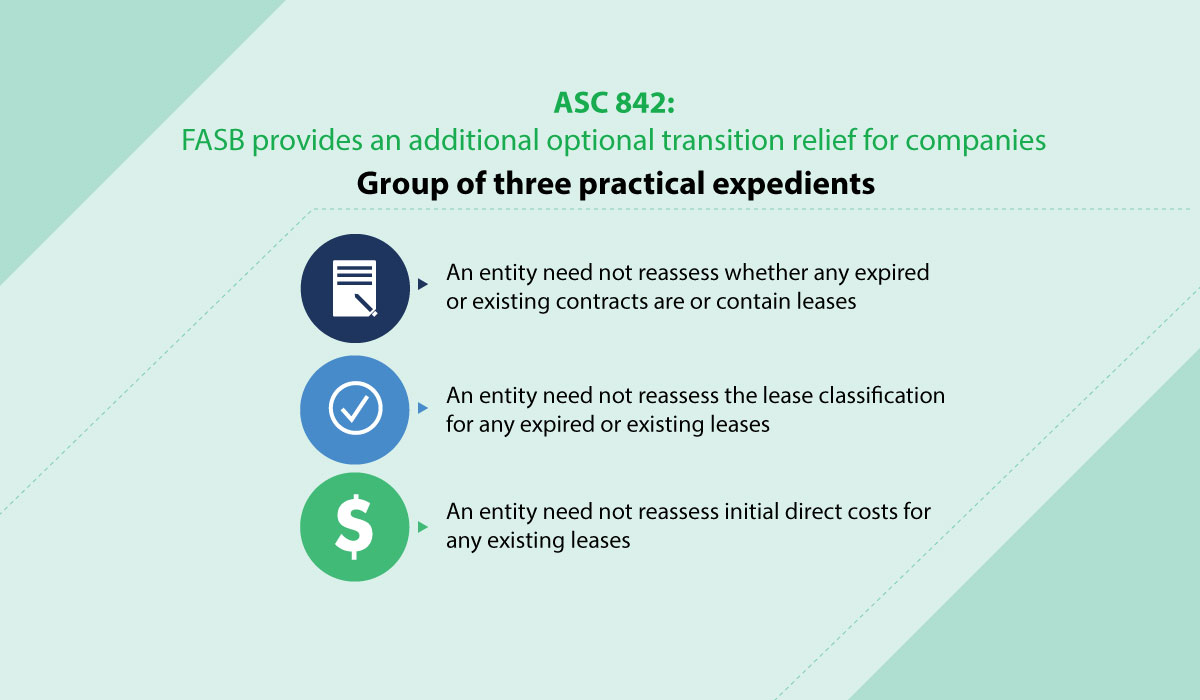

ASC 842: FASB provides an additional optional transition relief for companies

Tue, May 22, 2018 @ 03:19 AM / by Julio Dalla Costa posted in leasing, FASB, Leasing-Hot-Tips, ASC842, SAPLeaseAdmin

On January 5th, 2018, the Financial Accounting Standards Board (FASB) proposed adding an optional transition method and another practical expedient for lessors to Accounting Standards Codification (ASC) 842, Leases, to reduce the cost and complexity of implementing the new standard.

New Rapid Compliance Solution for Lease Accounting Standards ASC 842 and IFRS 16

Tue, May 15, 2018 @ 12:00 AM / by Bramasol Leasing Administration Team posted in Leasing-Hot-Tips, ASC842, SAPLeaseAdmin, IFRS16, RLCS

Bramasol, the leader in compliance and finance innovation solutions, has announced a new, purpose-built product that reduces complexity and implementation costs, to give companies across a variety of industries a ready-to-deploy solution for lease accounting disclosure reporting and compliance.

Watch how Bramasol helped a Leading Multinational Retail Giant comply with Leasing Standards ASC 842 and IFRS 16

Thu, Apr 5, 2018 @ 05:50 AM / by Bramasol Leasing Administration Team posted in ASC842, SAPLeaseAdmin, IFRS16, Leasing Solution

The customer is a Leading Global Organization and Multinational Retailing Corporation with annual revenues in excess of US$480 billion and which is one of the largest private employer in the world with over 2 million employees. As an international company, our customer is impacted by the new lease regulations ASC842 and IFRS16 that will take effect from January 2019.

New eBook: Lease Admin Solutions Need Scalability, Enterprise Performance and Native Integration

Tue, Oct 3, 2017 @ 10:45 AM / by Bramasol Leasing Administration Team posted in leasing, ASC842, IFRS16, Leasing Solution

In 2016, the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) issued new standards for lease accounting: IFRS 16 & ASC 842, which must be implemented by 2019. Both IFRS 16 and ASC 842 are the result of a joint effort between the IASB and FASB to meet the objective of improved transparency, comparability and financial reporting. These changes will impact virtually all companies, whether lessors or lessees.