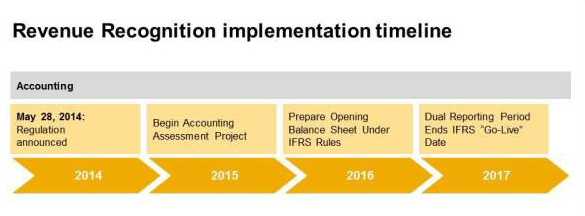

When January 1, 2017 arrives, companies across all industries that follow US GAAP and IFRS rules will be required to comply with the new five-step model for revenue recognition. On May 28, 2014, the FASB and the International Accounting Standards Board (IASB) issued converged guidance on recognizing revenue in contracts with customers. The process calls for implementation during 2016 and “go live” reporting under the new standards in 2017.

Unlike the previous revenue accounting standard that was industry-specific and transaction-specific, the goal of the FASB and the IASB in the new standard is to introduce uniformity and predictability to revenue recognition practices. Among the industries that are likely to experience significant changes are aerospace, asset management, construction, real estate, software and telecommunications. Changes won’t be limited to these industries, therefore all companies need to develop an implementation plan.

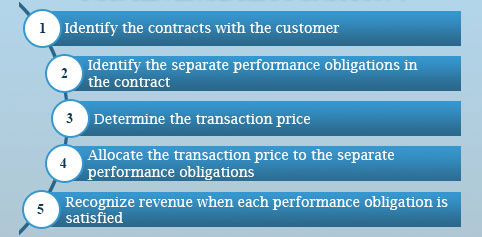

The new rules mandate Five Steps in the revenue recognition process as follows:

While it may seem like a long time until January 2017, the sweeping nature of these mandated changes requires an early start on implementation planning for a smooth transition and full compliance.

For a successful RevRec implementation, "early" means "Now". Most companies will need to do a significant amount of preparatory work and accounting assessment during 2015 before they can start to implement any system changes. They also need to have a well-planning schedule for piloting the new processes throughout 2016 in order to be ready for the January 2017 "go live" mandate.

To help companies get ahead of the curve on their pre-planning and structured implementation programs, Bramasol has developed an overview eBook for Assuring Success with New Revenue Recognition Requirements. This eBook outlines the Five Key Elements that must be addressed starting ASAP and lays out a road map to help keep implementation on track from now to January 2017 and beyond.

.png?width=3121&name=MicrosoftTeams-image%20(33).png)