Whether you’re a CFO or a financial controller, you know how much time and effort you and your team spend deep in concentration to get your monthly accounting figures to balance. Your accounts payable and accounts receivable work doesn’t get much attention unless things go wrong, but all the time you need to stay on top of your tasks to keep things running smoothly.

Julio Dalla Costa

Recent Posts

Can Automation and AI make the Monthly Accounting Close Obsolete?

Tue, Nov 27, 2018 @ 04:00 AM / by Julio Dalla Costa posted in cloud, analytics, financial transformation, FinancialTransformation-Hot-Tips, S4HANA, Thought Leadership, Hot Tips, Automation, Accounting, AI, Compliance

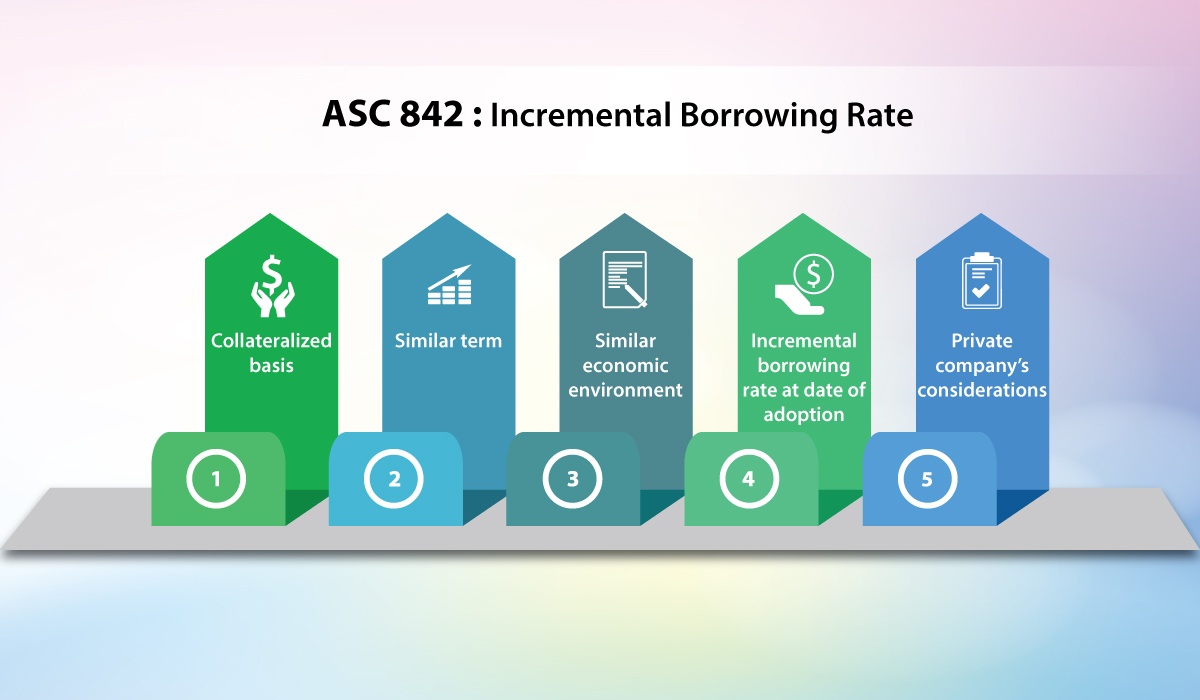

Understanding and applying incremental lease borrowing rate analyses under ASC 842

Tue, Jul 17, 2018 @ 04:57 AM / by Julio Dalla Costa posted in leasing, Leasing-Hot-Tips, SAPLeaseAdmin, ASC 842

In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02 ( “ASC 842”), Leases, which provides new guidelines that change the accounting for leasing arrangements.

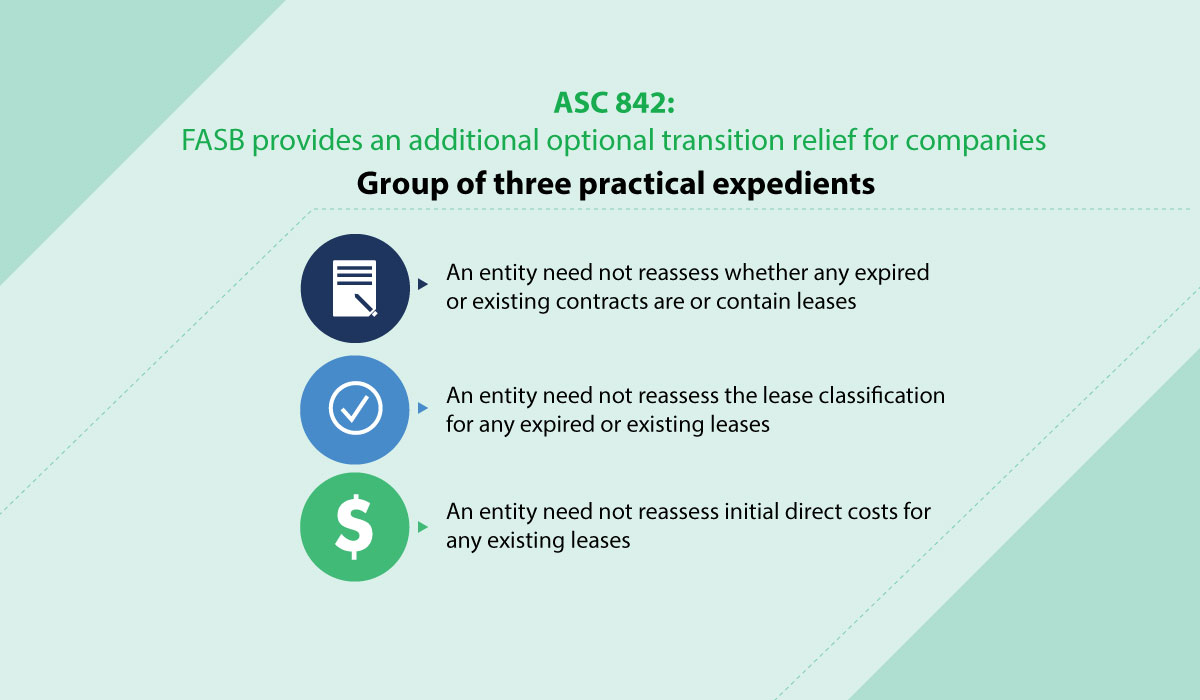

ASC 842: FASB provides an additional optional transition relief for companies

Tue, May 22, 2018 @ 03:19 AM / by Julio Dalla Costa posted in leasing, FASB, Leasing-Hot-Tips, ASC842, SAPLeaseAdmin

On January 5th, 2018, the Financial Accounting Standards Board (FASB) proposed adding an optional transition method and another practical expedient for lessors to Accounting Standards Codification (ASC) 842, Leases, to reduce the cost and complexity of implementing the new standard.